3 ways so you can acquire $10,000 away from domestic equity (and you will 2 a way to avoid) immediately

In the current large interest environment , playing cards, personal loans and basic lines of credit are extremely expensive possibilities getting borrowing from the bank currency. Anyway, credit card prices try nearing twenty-two% normally, unsecured loan cost are consistently from the double digits or any other alternatives have experienced prices go up so you’re able to membership that will be which have a great significant influence on value. Consequently, seeking a good answer to borrow are challenging.

not, that seemingly sensible credit alternative stays getting people, and is tapping into the newest guarantee they have manufactured in their houses . Thanks to years of quick household rate love, the common homeowner with home financing presently has nearly $3 hundred,000 in home guarantee collected. And you will, domestic equity credit costs are dramatically reduced as compared to cost on handmade cards, signature loans or other borrowing selection.

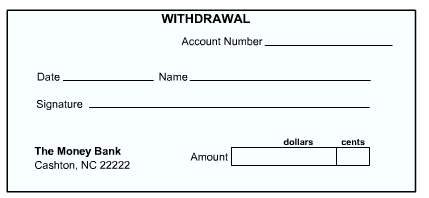

But given that average homeowner provides extensive domestic guarantee open to utilize, you don’t always need certainly to acquire anywhere near this much currency. Loan providers routinely have lowest credit limits of around $ten,000 getting family security products. And you will, if you are searching to help you acquire a smaller sized amount of money, this way lowest quantity of $ten,000, there are some family collateral scraping solutions which make feel now – and some that you may possibly need to keep away from.

three ways in order to obtain $ten,000 off household collateral at this time

Should you want to use $10,000 from your house’s collateral, you will find several options that you might want to consider, including:

Cum este oferta să mese live să Blackjack printre cazinouri online?

Cum este oferta să mese live să Blackjack printre cazinouri online?