Shareholders’ Agreements Sample & Download Templates

The capital of a company is divided up right into a small variety of elements known as shares. To increase what Is a shareholders agreement in cryptoinvesting the money required for the company’s every day operations, these shares may be bought on the open market. A one that purchases even one share in a company is considered a shareholder (or stockholder) of that company. Shareholders are the house owners of the corporate because they make investments cash in the company’s operation, and whatever gains or losses the company makes directly impact their possession stake.

- It is necessary, because it protects the company and the interests of other shareholders.

- The valuation depends on the parameters used, so your directions are crucial.

- The elementary informationwould be mandatory from your finish to start the method.

- A shareholders’ agreement additional supplies a sure degree of readability and specific construction regarding the relationship between the shareholders and the corporate.

Unrefined Drag-along And Tag-along Rights

A shareholders’ settlement (SHA) is a contract entered into by the shareholders of a company and sometimes the corporate itself. It regulates the connection between the shareholders and governs the management of the company. It outlines shareholders’ rights and obligations which therefore supplies protection for every shareholder. The settlement can present a framework for resolving disputes, similar to arbitration or mediation clauses. This can help to avoid costly and time-consuming legal battles, which could be detrimental to the corporate and its shareholders.

Drafting Shareholders’ Settlement

Yes, a shareholders’ settlement is a contract between the company and its shareholders and the settlement is ruled by contract regulation. A shareholders’ agreement is a non-public settlement between events and may be amended by consent. For instance, they aren’t allowed to work with a competitor agency in the identical geographical space. It is necessary, because it protects the company and the interests of different shareholders. A deed of adherence ensures new shareholders adhere to the pre-existing shareholders’ agreement.

What Is A Shareholders Contract?

It is on this basis, a requirement forays that the Shareholder Agreement shall be consistent with the Articles of affiliation of a company. The Shareholder Agreement can’t vitiate or state anything to the contrary contained within the Articles of Association and any such stipulation shall be void ab initio. In each state of affairs, the decision have to be made after an intensive debate among the many shareholders, and it goes to be primarily based on their unique calls for and circumstances. Declaring and paying dividends, issuing shares, appointing officers, and making choices outdoors of the normal course of enterprise are a variety of the more prominent examples.

Restrictions On Switch Of Shares

Shareholder’s Agreement safeguards the position or roles of shareholders, inside an organization, areprotected. A shareholder’s Agreement permits the right circumstances for developing amendments to the corporate’sconstitution. It is appropriate for ‘medium and small-scale’ businesses that do not want to officiallychange the whole structure each time small modifications are important to be produced from time to timebasis.

How Would Possibly The Shortage Of A Shareholders Contract Impression My Family Business?

Shareholders’ agreements shield the pursuits of each minority and majority shareholders in numerous circumstances and make for a more structured day-to-day management of the corporate. Another provision that can protect minority shareholders is named the “tag-along” provision. The provision applies when someone presents to buy shares from a majority shareholder. The shareholder isn’t allowed to promote unless the identical offer is made to all the other shareholders as nicely, including the minority ones.

Procedures For Buying And Promoting Shares

This clause sets out the roles and duties of the shareholders in relation to the administration and management of the company, and may include provisions on voting rights, decision-making processes, and the allocation of income and losses. One of the key purposes of shareholders’ settlement is to offer a framework for resolving disputes among the many shareholders. It units out the procedures for resolving disputes, together with the utilization of mediation, arbitration, or litigation. The agreement can also embody provisions for terminating the settlement in the occasion of a breach by one of the parties. A shares is a legally binding contract that outlines the process for transferring shares in a enterprise.

Get a well-drafted for determining the liaison between an organization’s shareholders and business,and to curtail all of your authorized hazards and avoid Litigations. The commonplace methodology for accomplishing this is to stipulate that between 75% and 90% of shareholders must lend a hand earlier than a particular motion could additionally be implemented. It would usually include terms concerning the admission of recent shareholders, such as approval and rights of first refusal. Yes, a shareholder’s agreement could be amended and even terminated, but often, such amendments must be consented to by all or some specified majority of shareholders, relying upon the phrases of the agreement. Voting rights can be allotted proportionally to shareholding or weighted unevenly so that majority voting influence resides with some shareholders.

Each Partner shall inform the other Partners about any intent to transfer the Partner’s shares, and in regards to the data to be given to 3rd parties in connection with such intent to transfer shares. The Partner(s) breaching the Competition Restriction Clause agree to promote their shares at a price that is 10% of their honest market worth (as outlined in Clause 9 below), pro rata of the other Partners’ ownerships. In addition, each Partner breaching the Clause agrees to pay [EUR i.e., 30,000 Euros] to The Company. Firstly, if greater than 2/3 of the shares owned by the Partners are supporting sure voting behaviour, then all Partners will vote in settlement with the 2/3 majority of Partners. The purpose is to establish that the Partners shall be unified, acting as a single group, even in the situations when there can be other shareholders in the Company than the Partners alone.

Additionally, it outlines the rights of shareholders in relation to the company. A shareholders settlement, also known as a stockholders agreement, is a legally binding contract between the shareholders of a company. It outlines the rights, obligations, and responsibilities of the shareholders in relation to the corporate and its management. A shareholders agreement sometimes covers issues such as the administration and management of the company, the rights and obligations of the shareholders, and the transfer and sale of shares. The major strengths of a shareholders’ agreement, nonetheless, are those providing protections for the minority shareholders.

A shareholders’ agreement is a contract that specifies how an organization might be dealt with and operated amongst its house owners. It often addresses issues just like the duties and rights of shareholders, how directors are chosen, how selections in regards to the company’s actions are made, and how disagreements are settled. An settlement that governs the relationship between shareholders, the administration of the business, share ownership, rights, duties, and the protection of shareholders is sometimes known as a shareholders’ agreement. A shareholders settlement serves to safeguard the interests of the shareholders by establishing a clear algorithm and laws for the administration and operation of the business.

It can assist in making certain that the business is conducted pretty and openly and in averting misconceptions and shareholder disputes. A shareholders’ settlement can also be a helpful instrument for luring traders and establishing the credibility of the agency as a outcome of it exhibits that the latter is well-organized and has a defined course for the longer term. By stopping future administration from abusing present shareholders’ pursuits, the shareholder settlement helps safeguard their interests.

A minority shareholder, for instance, might want to know that if she invests, will she be guaranteed a seat on the board of administrators. Shareholders in a USA can negotiate for extra safeguards similar to requiring a supermajority or unanimous vote on some crucial matters or expanding the record of actions that require shareholder consent. A unanimous shareholder settlement (“USA”) is intended to limit or revoke the powers of a corporation’s board of administrators in complete or in part.

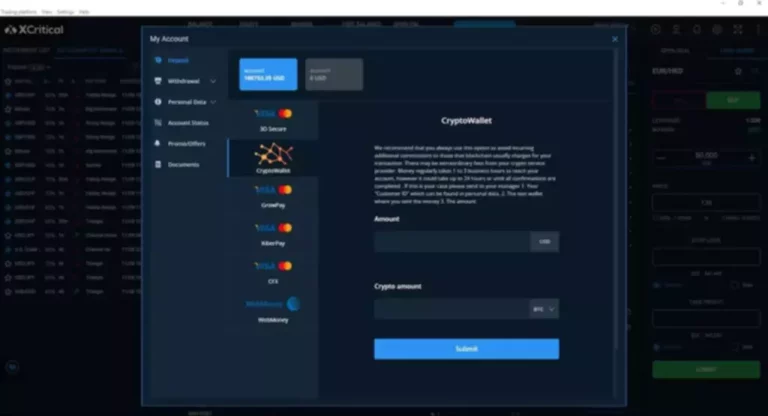

Read more about https://www.xcritical.in/ here.