Do i need to Rating a consumer loan otherwise Re-finance My Financial

Thinking about that loan to support an upcoming expenses? Whenever you are a homeowner, here are a couple of financing choices to imagine: You might https://paydayloanalabama.com/ariton/ make use of your residence guarantee having an earnings-away refinance or get paid reduced that have a personal bank loan.

What exactly is a personal loan?

Signature loans , a variety of personal bank loan, are supplied to prospects of the banking institutions, credit unions, or any other loan providers. Oftentimes, equity isn’t necessary to contain the financing.

You can expect to spend a fixed number monthly getting a-flat mortgage identity. Therefore the money obtain out of a personal bank loan can also be essentially be used for all the purpose.

Why should I have a consumer loan?

A personal loan can present you with liberty in terms of borrowing money. Whether or not you really need to renovate your home otherwise make a major get, an unsecured loan is also complement towards the financial needs without a lot of lead big date.

What is a funds-away home loan refinance?

That have a profit-out mortgage refinance , you update your present financial so it’s getting a larger matter than your already are obligated to pay. Your financial are reduced while have the more money that you might want for the project.

- Earnings

- Employment

- Loans

- Value of

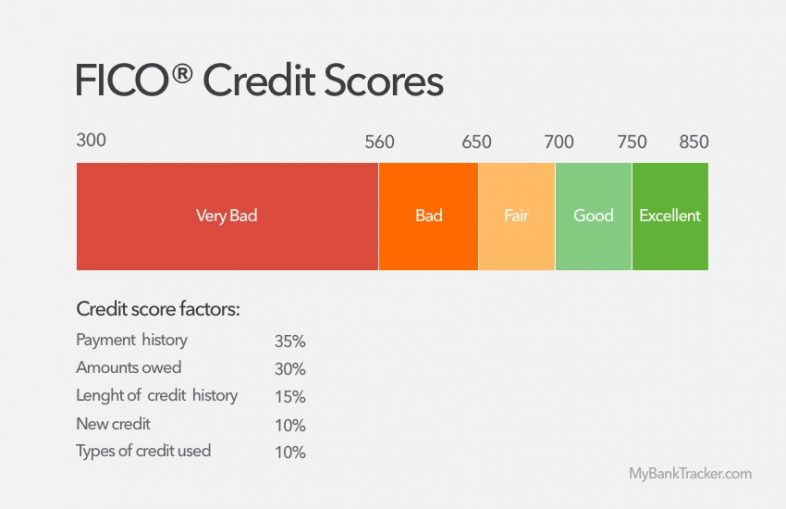

- Credit rating

Exactly how are a consumer loan unique of a funds-away home loan refinance?

Differences between the two mortgage brands include the collateralization process, interest rates, rates out of financing, mortgage quantity, financing charges, installment symptoms, as well as potential taxation gurus.

Security and Home Guarantee

Quite often, to help you be eligible for an earnings-out refinance loan, you truly need to have guarantee of your home. Fundamentally, your own lender will need one remain 20% security, and this constraints your loan amount so you can 80% of your own residence’s appraised worth.

Alternatively, extremely personal loans is unsecured. It’s not necessary to worry about giving security or becoming minimal by number of guarantee you have in your home.

Rates

Fundamentally, home financing gives a lesser rate of interest than a great personal bank loan since it is secure by your property. Yet not, unsecured loans typically bring straight down rates of interest than simply most credit cards with non-introductory prices.

Each other bucks-aside refinances and personal fund can be accustomed repay high-appeal loans. The speed you can get try affected by your credit rating, income, while the amount borrowed.

Mortgage costs can alter each hour, and if you are leaning that channel, you need to keep in mind mortgage pricing .

Price regarding Processes

The newest acceptance processes to own a home loan generally involves an appraisal and detail by detail underwriting, and also other criteria all of which need go out.

Loan Amounts

Yet not, often a finances-away re-finance is safer a lesser rate of interest and you can help save you profit the long term. If that is your position, your ount of money you’re trying.

Financing Charges

The charges of the either types of loan will depend on the lender you decide on. But not, various 0% to 5% of one’s loan amount is normal private funds, and you may a selection of .25% to 3% of your amount borrowed is common to possess a mortgage.

All of the fees energized to own a home loan should be spend to possess requisite 3rd party services. This can include escrow, title insurance, and you can an assessment. The lender fee, often described as origination percentage, running fee, or underwriting percentage, are billed by the originator of the loan.

Considering regular payment range, you might fundamentally expect to pay far more inside charge to have an excellent financial when designing a buck-for-dollars testing. That is because the cost payment is actually applied to the entire house amount borrowed and not soleley the money-away amount. Although not, this may are very different with regards to the dollars-aside count, financial amount, plus the rates of interest considering.