S., the product quality limit restriction towards right back-stop ratio was 36% on the antique home mortgage loans

Debt-to-earnings proportion (DTI) ‘s the ratio of complete financial obligation money separated because of the gross income (in advance of tax) conveyed once the a share, constantly on either a month-to-month or annual base. Due to the fact a quick analogy, if the another person’s month-to-month money try $step 1,000 and purchase $480 into obligations every month, their DTI proportion is 48%. Whenever they didn’t come with obligations, their proportion is actually 0%. You can find different kinds of DTI ratios, many of which is actually explained in more detail below.

There is certainly an alternate proportion known as credit application proportion (sometimes titled obligations-to-borrowing from the bank proportion) that is will chatted about including DTI that works a little differently. Your debt-to-borrowing proportion is the portion of simply how much a debtor owes compared to the their credit limit and also an effect on the credit history; the higher the fresh new commission, the lower the financing score.

DTI is an important indicator from a person’s or a family’s loans top. Lenders make use of this shape to assess the risk of financing to help you all of them. Creditors, collectors, and you will vehicle traders is also all of the have fun with DTI to evaluate its chance of accomplishing organization with various anybody. A person with a top proportion is seen of the loan providers just like the a person that is almost certainly not able to pay-off whatever they owe.

Various other loan providers enjoys different requirements for just what a reasonable DTI are; a credit card issuer you are going to glance at you aren’t a beneficial forty-five% ratio since appropriate and you can matter them a charge card, but a person who brings signature loans could possibly get notice it as the as well highest and never stretch a deal. It is only one indication utilized by loan providers to assess the likelihood of each borrower to determine whether or not to continue a deal or otherwise not, whenever so, the advantages of financing. Officially, the lower the brand new proportion, the higher.

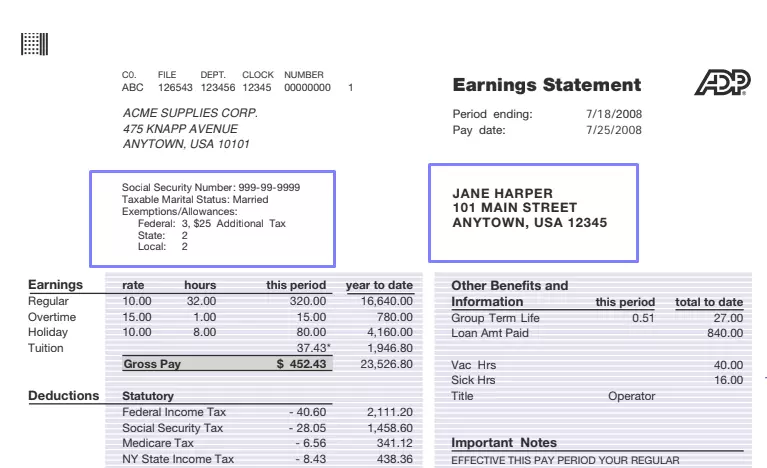

Front-prevent obligations proportion, often entitled mortgage-to-income proportion in the context of house-to order, try calculated of the dividing total monthly construction will cost you by month-to-month gross earnings. The leading-avoid proportion comes with not merely leasing or mortgage payment, and almost every other expenses associated with casing including insurance, possessions taxes, HOA/Co-Op Commission, etc. From the You.S., the quality maximum front side-stop maximum used by traditional mortgage loan lenders was twenty eight%.

Back-stop debt ratio ‘s the even more every-encompassing obligations with the just one otherwise household. It includes all things in the front-avoid ratio dealing with casing will cost you, together with any accrued monthly financial obligation particularly auto loans, student loans, handmade cards, etc. That it proportion is sometimes recognized as the fresh better-known loans-to-earnings ratio, which will be a lot more popular as compared to top-avoid ratio. Regarding You.

Home Cost

In the us, lenders use DTI in order to meet the requirements domestic-buyers. Generally speaking, leading-stop DTI/back-stop DTI limitations getting traditional capital are , the new Federal Houses Management (FHA) limitations are , therefore the Virtual assistant loan restrictions is actually . Please use our house Affordability Calculator to test brand https://elitecashadvance.com/loans/second-chance-payday-loans new debt-to-earnings ratios whenever determining maximum home loan financing quantity having for every single being qualified domestic.

Monetary Wellness

When you’re DTI rates is commonly used because tech devices by the lenders, capable be used to test individual monetary health.

In the us, typically, a good DTI of 1/step three (33%) or reduced is considered to be manageable. A great DTI of 1/2 (50%) or more is generally considered too much, since it setting no less than 1 / 2 of money was spent only with the obligations.

Ideas on how to All the way down Obligations-to-Money Ratio

Boost Income-You can do this courtesy working overtime, using up an additional work, requesting an income raise, or creating money from a hobby. In the event that financial obligation top stays an identical, a high money can lead to less DTI. The other way to lower the proportion is to try to straight down the debt count.

Budget-Of the recording purchasing courtesy a resources, you’ll get a hold of areas where expenditures might be cut to attenuate obligations, should it be holidays, dinner, otherwise shopping. Really spending plans plus help to song the level of debt versus earnings each month, which can help budgeteers work at the newest DTI requirements they set for themselves. To learn more in the or to would computations away from a spending budget, please go to this new Funds Calculator.

Make Personal debt More affordable-High-attract expenses instance playing cards might end up being lower using refinancing. An effective 1st step is to try to telephone call the credit card organization and get if they can reduce steadily the rate of interest; a debtor that always will pay its expense timely which have an enthusiastic membership inside the good standing can be provided a lower speed. Another approach is to merging the large-focus debt with the a loan having a lowered rate of interest. For more information regarding or even to manage calculations related to a credit card, please visit the financing Card Calculator. To learn more throughout the or perhaps to create calculations connected with debt consolidation, kindly visit the debt Integration Calculator.