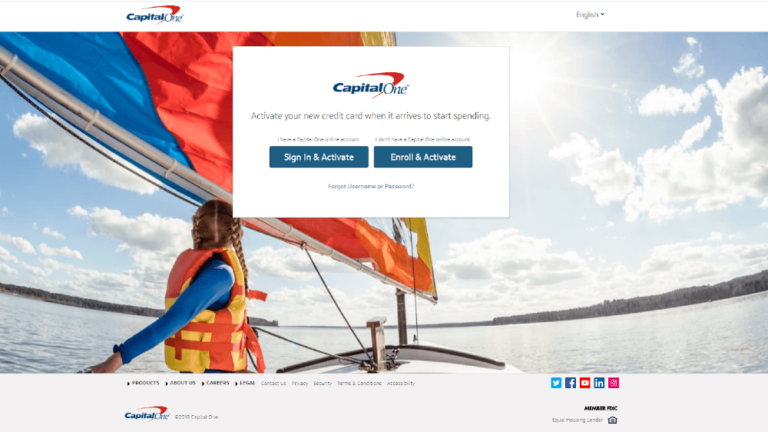

Changes Your home With A renovation Financing

Home Renovation Financing

Thanks for visiting Blue Arrow Financing, your own top origin for re regarding advantages is serious about providing your which have versatile investment options for all home recovery need.

Regardless if you are trying to would a primary redesign or create a number of developments, Bluish Arrow Financing can help you support the funds you need to discover the employment done right. Our recovery mortgage choice is domestic resolve fund, do it yourself finance, and even fixer-upper fund for those trying undertake a task.

We provide mortgage recovery funds and you will refinancing options to help you maximize your home’s security and improve your worth of. Our acceptance procedure is quick and easy, with aggressive interest rates and you will loan amounts which might be tailored to your specific means.

At Bluish Arrow Lending, our company is committed to providing the clients with exceptional provider and you will help regarding the whole percentage techniques. We’re going to make it easier to navigate the fresh new income tax benefits associated with their recovery endeavor and supply professional advice to the contractor and you will Doing it yourself solutions.

Whether you’re seeking redesign your property otherwise a professional assets, Bluish Arrow Credit gets the possibilities and you can capital choices to build your vision a reality. E mail us today to learn more about the repair mortgage options.