Do i need to Rating a consumer loan otherwise Re-finance My Financial

Thinking about that loan to support an upcoming expenses? Whenever you are a homeowner, here are a couple of financing choices to imagine: You might https://paydayloanalabama.com/ariton/ make use of your residence guarantee having an earnings-away refinance or get paid reduced that have a personal bank loan.

What exactly is a personal loan?

Signature loans , a variety of personal bank loan, are supplied to prospects of the banking institutions, credit unions, or any other loan providers. Oftentimes, equity isn’t necessary to contain the financing.

You can expect to spend a fixed number monthly getting a-flat mortgage identity. Therefore the money obtain out of a personal bank loan can also be essentially be used for all the purpose.

Why should I have a consumer loan?

A personal loan can present you with liberty in terms of borrowing money. Whether or not you really need to renovate your home otherwise make a major get, an unsecured loan is also complement towards the financial needs without a lot of lead big date.

What is a funds-away home loan refinance?

That have a profit-out mortgage refinance , you update your present financial so it’s getting a larger matter than your already are obligated to pay. Your financial are reduced while have the more money that you might want for the project.

- Earnings

- Employment

- Loans

- Value of

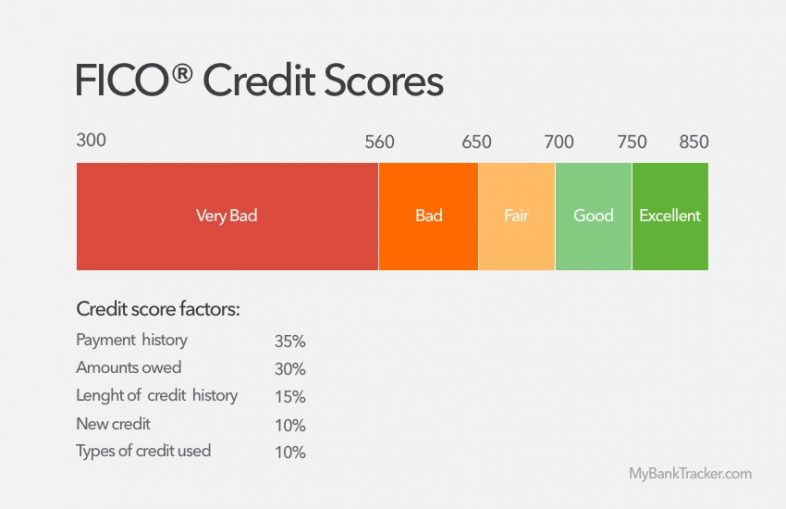

- Credit rating

Exactly how are a consumer loan unique of a funds-away home loan refinance?

Differences between the two mortgage brands include the collateralization process, interest rates, rates out of financing, mortgage quantity, financing charges, installment symptoms, as well as potential taxation gurus.