Simple tips to Pertain Which have a premier Mortgage lender

Particular lenders operate better for sure individuals otherwise activities than just anybody else. Eg, we feel Skyrocket Mortgage is an excellent bank to own refinancing since the it’s the ability to personalize their identity length, that allows one prevent resetting your loan identity.

Good for First-Go out Customers

Within our help guide to the best mortgage brokers having first-date homebuyers, Financial off The usa are our very own ideal get a hold of. A beneficial lender to own basic-big date buyers would be to promote funds featuring especially geared toward such consumers. Discover loan providers with lowest-down-commission mortgage loans and gives a lot more let such as for example deposit gives.

Perfect for Regulators-Supported Mortgages

- Within our guide to an informed lenders for FHA financing, The new Western Money try our top pick

- Experts Joined is the “best overall” get a hold of in our ideal Virtual assistant loan providers guide

- Fairway Independent try the top pick to own USDA loan lenders

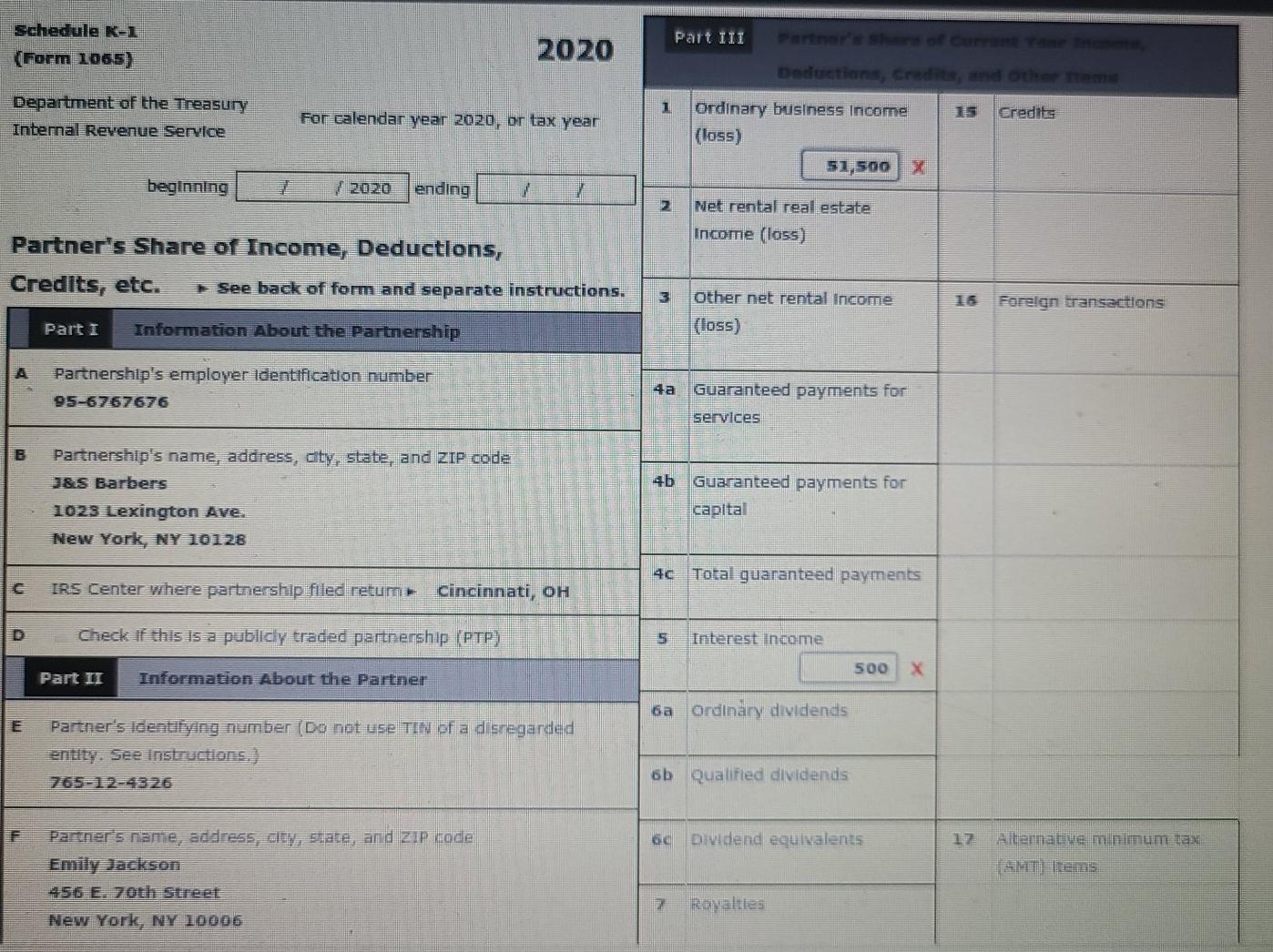

Planning The Records

Lenders have a tendency to ask for a variety of data once you sign up for a home loan, so it is best if you have them working ahead of time. This will likely include paystubs, W-2s otherwise 1099s, tax returns, financial comments or other house membership statements, and any other papers demonstrating your revenue and you will offers.

Understanding the Mortgage Application Process

Generally, the loan app techniques begins with a great preapproval. With this specific style of acceptance, the lender takes a glance at your own borrowing from the bank and you can profit and let you know simply how much it is ready to give you based on the recommendations it looked at. You plan to use your preapproval buying belongings and then make also offers.

After you’ve a deal acknowledged, you can easily apply for approval.