Over-the-Counter OTC Markets: Trading and Securities

Content

- Risks and rewards of OTC trading

- What foreign companies sell their stocks on OTC Markets?

- Are there any specific regulations or reporting requirements for OTC stocks?

- What Is the Marketplace for OTC Stocks?

- How OTC Stocks Are Different From Other Stocks

- What are the over-the-counter (OTC) markets?

- What is over-the-counter trading?

- How Can I Invest in OTC Securities?

It does not require any SEC regulation or financial reporting, and includes a high number of shell companies. There are several well-known networks for OTC trading, which are distinct in terms of the securities they offer investors. The primary advantage of OTC trading is the wide range of securities available on the OTC market. Several types of securities are available to investors solely or primarily through OTC trading. Certain types of securities are frequently traded OTC, rather than through a formal exchange. Finally, because of the highly speculative and higher what is an otc trade risk backdrop of investing in OTC securities, it’s important to invest only an amount of money that you are comfortable losing.

Risks and rewards of OTC trading

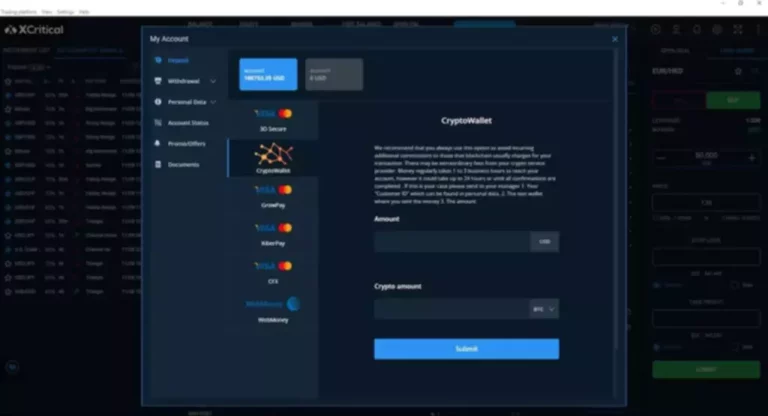

If you watch Level 2 on an OTC, you may see something strange. There’s usually a seller at a much higher price than the current action. Now, if you place a market https://www.xcritical.com/ buy order and you get routed to that broker-dealer — well, you might be the one taking that offer.

What foreign companies sell their stocks on OTC Markets?

I know it’s a slight nuance, but it makes a difference in how the securities trade. These days, in addition to providing quotation services, OTC Markets provides information. Its website has up-to-date information on news, volume, and price. It’s changed its name a few times since it formed — it was originally the National Quotation Bureau — but it’s always worked in OTC trading.

Are there any specific regulations or reporting requirements for OTC stocks?

In 1999, it became the first company to bring electronic quotation services to the OTC markets. These schemes often use OTC stocks because they are relatively unknown and unmonitored compared to exchange-traded stocks. Rebate rates currently vary from $0.06-$0.18 per contract depending on the date of enrollment and number of referrals you make. The exact rebate will also depend on the specifics of each transaction and will be previewed for you prior to submitting each trade. This rebate will be deducted from your cost to place the trade and will be reflected on your trade confirmation.

What Is the Marketplace for OTC Stocks?

These companies must have audited financials and meet a minimum bid price of $0.01. They must also be up-to-date on current regulatory reporting requirements, and not be in bankruptcy. An over-the-counter derivative is any derivative security traded in the OTC marketplace.

How OTC Stocks Are Different From Other Stocks

No offer to buy securities can be accepted, and no part of the purchase price can be received, until an offering statement filed with the SEC has been qualified by the SEC. An indication of interest to purchase securities involves no obligation or commitment of any kind. For example, many hugely profitable global companies that are listed on foreign exchanges trade OTC in the U.S. to avoid the additional regulatory requirements of trading on a major U.S. stock exchange. Buying stocks through OTC markets can also provide the opportunity to invest in a promising early-stage company.

What are the over-the-counter (OTC) markets?

Investments in T-bills involve a variety of risks, including credit risk, interest rate risk, and liquidity risk. As a general rule, the price of a T-bills moves inversely to changes in interest rates. Although T-bills are considered safer than many other financial instruments, you could lose all or a part of your investment.

If you place a market order with an OTC, you can wind up paying any price for the stock — and it likely won’t be in your favor. Remember that OTCs are the underbelly of the stock market, where many companies go to die. If you wind up holding the bag on some of these OTCs, you could be holding the bag for life. Many kinds of trading vehicles — securities — exist in the OTC markets.

How Can I Invest in OTC Securities?

- We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

- We’ll explore the key OTC market types, the companies that tend to trade on them, and how these markets are evolving in today’s electronic trading environment.

- The first step an investor must make before trading OTC securities is to open an account with a brokerage firm.

- This is because OTC stocks are, by definition, not listed on the exchange.

- They have always had a reputation for where you find the dodgiest deals and enterprises, but might also find future profit-makers among them.

If you’re seeking to sell your OTC equities, you might find yourself out of luck because you simply can’t find a buyer. Additionally, because OTC equities can be more volatile than listed stocks, the price might vary significantly and more often. The OTC markets are a barely regulated, high-risk marketplace where delisted and unlisted stocks trade. If you think of the major exchanges as a bank, the OTC markets are like the alley behind the bank. In addition to the decentralized nature of the OTC market, a key difference is the amount of information that companies make available to investors.

Some foreign companies trade OTC to avoid the stringent reporting and compliance requirements of listing on major U.S. exchanges. OTC markets, while regulated, generally have less strict listing requirements, making them attractive for companies seeking to access U.S. investors without the burden of SEC registration for an exchange listing. In the U.S., the majority of over-the-counter trading takes place on networks operated by OTC Markets Group. This company runs the largest OTC trading marketplace and quote system in the country (the other main one is the OTC Bulletin Board, or OTCBB).

In the late 1990s, Pink Sheets transitioned to an electronic quotation system, eventually becoming the OTC Markets Group, which operates the OTCQX, OTCQB, and OTC Pink platforms. It’s easy to get started when you open an investment account with SoFi Invest. You can invest in stocks, exchange-traded funds (ETFs), mutual funds, alternative funds, and more. SoFi doesn’t charge commissions, but other fees apply (full fee disclosure here).

The Pink Sheets or Pink Open Market has no minimum financial standard that companies are required to meet, nor do they have reporting or SEC registration requirements. These are only required if the company is listed on a Qualified Foreign Exchange. Penny stocks, shell corporations, and companies that are engaged in a bankruptcy filing are excluded from this grouping. It’s common to find stocks from foreign companies (e.g. foreign ordinaries) listed here.

You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. For example, if you’re in the UK and wanted to trade stocks in a company listed in Germany, you could do it through OTCQX. Given the stock price and status of the companies traded within this tier, the securities are subject to strict regulatory oversight. Also, the companies listed have to meet the highest reporting standards possible. All investing involves risk, but there are some risks specific to trading in OTC equities that investors should keep in mind. Compared to many exchange-listed stocks, OTC equities aren’t always liquid, meaning it isn’t always easy to buy or sell a particular security.

The case is, of course, one of many OTC frauds targeting retail investors. Glaspie pleaded guilty in 2023 to defrauding more than 10,000 victims of over $55 million through his “CoinDeal” investment scheme. The second-largest stock exchange in the world focuses on technology. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

See Jiko U.S. Treasuries Risk Disclosures for further details. For instance, companies which do not meet requirements to be traded on a major stock exchange, including the shares of some major international companies, are often traded OTC instead. In addition, some types of securities, like corporate bonds, are generally traded OTC. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 70% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Some specialized OTC brokers focus on specific markets or sectors, such as international OTC markets or penny stocks. These brokers may provide access to a wider range of OTC securities but may also charge higher fees or have more stringent account requirements or minimum transaction sizes. Trading foreign shares directly on their local exchanges can be logistically challenging and expensive for individual investors. Suppose you manage a company looking to raise capital but don’t meet the stringent requirements to list on a major stock exchange. Or you’re an investor seeking to trade more exotic securities not offered on the New York Stock Exchange (NYSE) or Nasdaq.

A derivative is a financial security whose value is determined by an underlying asset, such as a stock or a commodity. An owner of a derivative does not own the underlying asset, in derivatives such as commodity futures, it is possible to take delivery of the physical asset after the derivative contract expires. When companies do not meet the requirements to list on a standard market exchange such as the NYSE, their securities can be traded OTC, but subject to some regulation by the Securities and Exchange Commission.

The shares for many major foreign companies trade OTC in the U.S. through American depositary receipts (ADRs). These securities represent ownership in the shares of a foreign company. They are issued by a U.S. depositary bank, providing U.S. investors with exposure to foreign companies without the need to directly purchase shares on a foreign exchange. In practice, buying and selling OTC securities may not feel much different than buying and selling securities that trade on a major exchange due to electronic trading. Also, you can trade many OTC securities using most mainstream brokerage accounts.

Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. If you’re interested in OTC trading, the first step is to consider how much risk you’re willing to take on and how much money you’re willing to invest. Having a baseline for both can help you to manage risk and minimize your potential for losses.

Futures and to provide a better trading experience for all users. USDⓢ-Margined Futures Liquidity Provider Program is designed to incentivize participants to provide liquidity for USDⓢ-Margined Futures trading pairs.

Futures and to provide a better trading experience for all users. USDⓢ-Margined Futures Liquidity Provider Program is designed to incentivize participants to provide liquidity for USDⓢ-Margined Futures trading pairs.