Trend Trading: The 4 Most Common Indicators

Just to level-set your expectations, these sort of trends are hard to find. The above chart is a clear example of when a stock is trending really hard. To add more validity to the trend, the averages are also far apart all the way down. Nonetheless, if you are trend trading, the move should be strong enough for you to care. For bullish trends, you want to connect the low points and high points to develop an up channel.

Technical Analysis in Trend Trading

Technical analysis is just one part of a successful trend trading strategy. Without proper preparation and risk management, even the best trading strategy won’t make you money in the long run. Most trend traders will not take note of these trends, but range traders or scalpers – who seek to take advantage of extremely short-term market movements – will look out for these bounded movements. This type of trend is usually used by companies that have been in business for a long time. This is because horizontal trends take place over long periods, such as years. Analyzing changes over a longer period of time provides information on the company’s financial flow, as well as data patterns it can use as a future example.

Staying informed about global developments could help you to anticipate potential shifts in the market. Staying updated on market trends is key to making informed investment decisions. A downtrend occurs when high exposure rock climbing a stock is consistently making lower lows and lower highs. This indicates that sellers are in control and the price is moving downward over time.

How To Find Stocks For Swing Trading

A trader would open as many positions as possible throughout the trading day to take advantage of any direction the price is moving. Similarly, the asset is considered a downtrend when the 200-day SMA is angled to the downside, and the price is below it. Consequently, traders can look to enter short or sell positions whenever the price bounces back close to the MA, resulting in the formation of a strong sell candlestick. Major economic events, such as central bank announcements, employment reports, or geopolitical developments, can significantly influence trends. These events often create sudden shifts in market momentum, which trend traders must carefully monitor to avoid false signals or take advantage of emerging opportunities.

Avoiding false signals

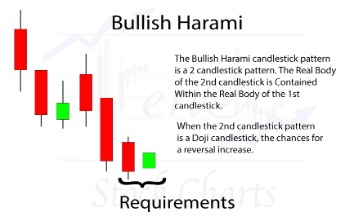

These tools help to filter out market noise and provide objective criteria for trend identification. The other risk management strategy is simply to exit your trades manually when they get to certain levels. You can exit a trade when the chart starts forming reversal patterns like head and shoulders, double-top and bottom, and wedge. In summary, trend trading is a widely employed and adaptable trading strategy, which focuses on capitalising on market momentum through the questrade forex identification and pursuit of prevailing trends. The chart above highlights activity over a few weeks and shows the 9-day moving average and 21-day moving average, trendlines and the RSI indicator below. Momentum indicators are used to measure the strength of a trend and can help traders identify potential entry and exit points.

What are the types of trends?

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.This document should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document is for information purpose only and should not be construed as a promise on minimum returns or safeguard of capital. This document alone is not sufficient and should not be used for the development or implementation of an investment strategy. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon.

Trend trading is a popular strategy used in the financial markets to capitalize on the direction of price movements. Traders who employ this method aim to identify and ride the prevailing trend, whether it is an upward or downward movement, to generate consistent profits. Trend trading is a strategy that involves identifying the direction of a prevailing trend in the financial markets and then buying or selling assets in accordance with that trend. Let’s close the short position once the indicator drops below 30 and, after some time, starts bouncing back. Consequently, the asset is considered bullish if the stock price is above the 200-day moving average on the daily or weekly chart. A trader would look to open a buy position on any weakness in the market.

Trend channel trading involves identifying the boundaries of a trend channel, which are formed by drawing parallel trendlines. Traders look for trading opportunities near the support or resistance levels of the channel, buying at the lower trendline during an uptrend and selling at the upper trendline during a downtrend. This strategy allows traders to trade within the confines of a trend and take advantage of price bounces off the channel boundaries.

They will look for patterns in price movements and analyse charts to establish areas of support and resistance. Trend trading strategies empower traders to navigate financial markets more precisely and confidently. By understanding the principles of trend identification, leveraging technical indicators, and employing risk control measures, traders can align their trades with market momentum.

- Companies use trend analysis to stay ahead of the competition by acquiring useful information about their business before it goes mainstream.

- Momentum tradingMomentum trading relies on technical indicators like the RSI or MACD to identify trends with strong price action.

- When the economy is weak, less demand for your product or service may occur, which can reduce profits.

- Trend Trading is a style of trading in which the investor aims to acquire profits by determining the widespread trend of an asset as it moves in a particular direction.

What is the importance of recognizing market trends?

For example, if a company’s share price increases by 100p, then declines by 50p, then rises by 110p and falls by 40p, it would be said to be in an uptrend as it is making higher highs and higher lows. This could be due to many reasons, including the increase in the price of assets and stocks, as well as job growth. A strong economy leads to job opportunities and the ability to invest in stocks. It is also a good time to take into account the rising costs of materials you may need, which may increase prices.

A reversal, on the other hand, is an approach that aims to enter a trade when an asset is about to change direction. Reversal traders then become trend-followers since their aim is to ride the existing trend until it ends. Trend following (or trend trading) is one of the most popular day trading strategies in the market. It is also popular among novices because of its (relative) ease of application. Note, however, that all trading, including trend following, contains high risk of a loss. Markets move up and down, trends reverse, and past performance is not a guarantee of future results.

Moving averages are perhaps the most straightforward and widely used trend indicators. For instance, a 20-day moving average is calculated by averaging the closing prices of the previous 20 days. This generates a smoothing effect that enables traders to more quickly determine trend direction by eliminating the impact of short-term price changes and other market noise. By incorporating the principles and strategies discussed in this Forex scalping strategy article, traders can navigate the markets with confidence, identify profitable trends, and mitigate risks.

- The average directional index (ADX) is used by traders to determine the strength of a trend – whether this is up or down.

- Like any trading method, swing trading comes with its own set of pros and cons.

- On the other hand, if the price hovers in a certain range, this is not a trend but a consolidation phase.

- An uptrend occurs when the price of an asset is consistently making higher highs and higher lows.

- 70% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

Assessing the risk-to-reward ratio is important for proper risk management in trend trading. Traders should consider the potential reward of a trade in relation to the risk undertaken. A favorable risk-to-reward ratio ensures that the potential profit on a trade outweighs the potential loss.

The 2 most common types are the Simple Moving Average (SMA), which averages the prices over a specified period, and the Exponential Moving Average (EMA), which gives more weight to recent prices. When the price is above the moving average, it signifies an uptrend; when it’s below, it indicates a downtrend. A Moving Average Crossover, where a shorter-period MA crosses a longer-period MA, often confirms a new trend. Sometimes, what appears to be a trend may just be a short-term fluctuation in price, leading to false signals and potential losses. Suppose you identify an upward trend in a stock, backed by increasing volume and positive news.

However, trend traders may overlook these opportunities due to their focus on riding the primary trend. One of the challenges of trend trading is that by the time a trend is identified and confirmed, a significant portion of the price movement may have already occurred. Similarly, trends can reverse abruptly, and traders may exit their positions late, resulting in missed exit points and potential losses. Trend trading is a strategy used by traders to analyze and take advantage of the directional movement in the markets. The underlying principle of trend trading is based on the belief that markets tend to move in trends rather than random price fluctuations. By identifying and following these trends, traders aim to profit from the continuous price movements in a given direction.

.jpeg)

.png)