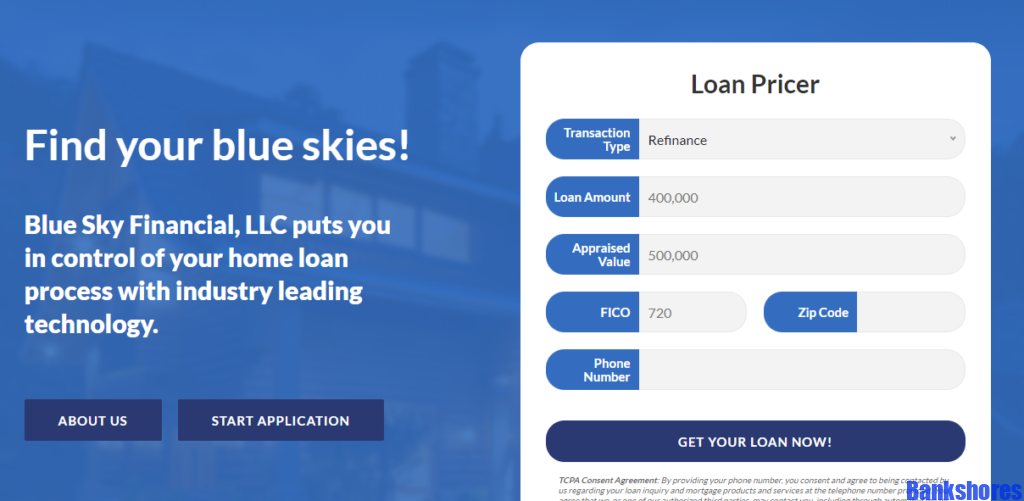

Pty Ltd ACN 161 358 363 works because an enthusiastic Australian Economic Characteristics Licensee and an Australian Credit Licensee Number 515843

Because 1995 we’ve get redirected here been providing Australians learn about owning a home, evaluate home loans and also help from financial pros so you can find the right mortgage in their eyes.

The Mortgage

- Editorial Assistance

- Advertise with our team

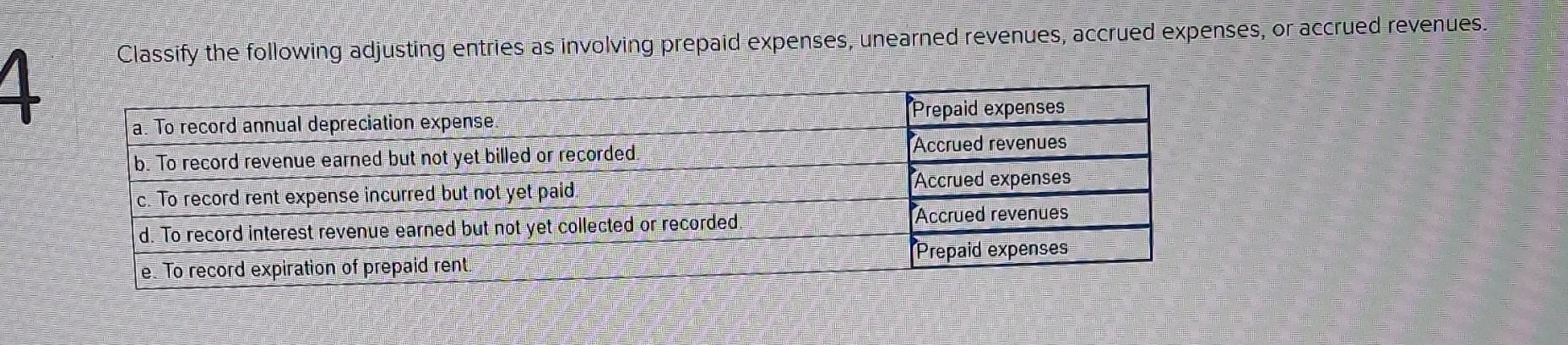

Mortgage Research

- Contrast Lenders

- Refinancing Lenders

- Money spent Money

- Earliest Domestic Consumer Funds

Hand calculators

- Financial support Development Tax Calculator

- LMI Calculator

- Financial Calculator

- Stamp Duty Calculator

Mortgage brokers

The whole industry was not felt in choosing the above points. Instead, a cut out-down part of the business might have been thought. Particular providers’ circumstances may not be found in all the claims. To-be experienced, the product and you can rate must be obviously composed on the product provider’s website. , , , , and gratification Push are part of brand new InfoChoice Category. In the interests of full disclosure, this new InfoChoice Category try in the Firstmac Group. Read about exactly how Infochoice Category takes care of possible conflicts of interest, plus exactly how we receives a commission.

is actually a general pointers supplier plus in providing you standard product recommendations, isn’t making one suggestion or testimonial in the one type of unit and all sorts of markets facts might not be experienced. If you opt to submit an application for a card product noted on , you’ll contract yourself with a card vendor, rather than that have . Prices and you will product information will be affirmed toward associated credit seller. To find out more, see is the reason Monetary Features and Credit Publication (FSCG) The information considering comprises advice that’s standard in nature and you can has not yet taken into account all of your individual expectations, financial situation, otherwise requires.