Why must You prefer a money-Out Re-finance Bank?

- Punctual resource: Funds close in typically 21 weeks

- Flexible loan numbers: Acquire out-of $25,000 around $five-hundred,000

- Highest mortgage-to-value: Well-certified individuals can be acquire around 95% of the residence’s worthy of

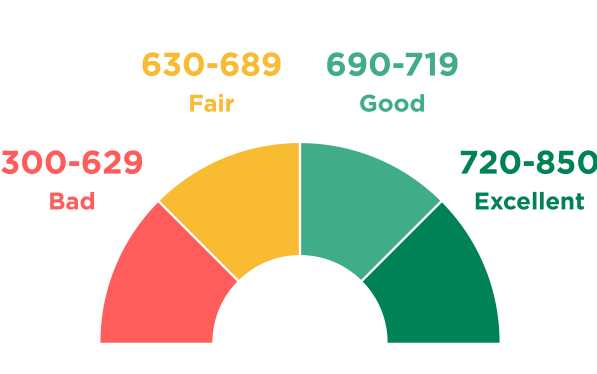

- High credit score expected: Need a credit rating with a minimum of 640

- 40 says: Simply serves on the forty claims and you may Washington, D.C.

- No online rates prices: Cannot discover speed quotes on the web

What is actually a cash-Out Refinance Bank?

A cash-out re-finance financial is a lending company that assists residents replace their primary mortgage loans with new, huge funds and money from variation. Such as for example, when your house is worthy of $450,000 and you can a lender possess a keen 85% loan-to-well worth maximum, you could acquire as much as $382,five-hundred. If you nonetheless owed $two hundred,000 on the domestic, you will be in a position to cash out up to $182,five-hundred.