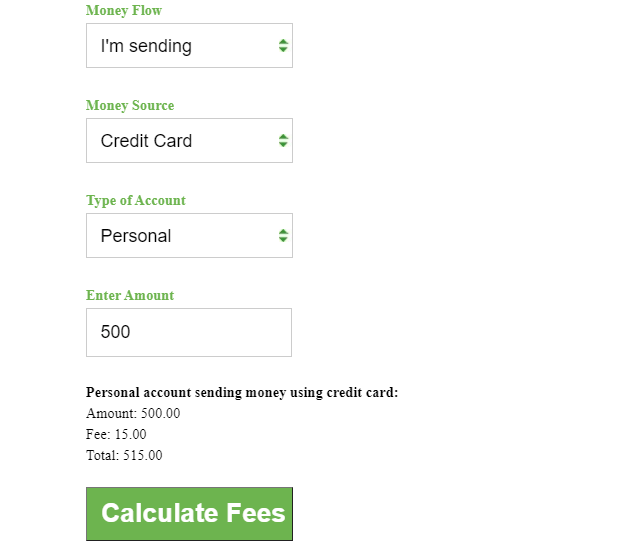

The level of entitlement varies on amount borrowed

Gulf coast of florida Combat: Experts of your Gulf War time, and this first started Aug. 2, 1990, and can keep up to Congress or perhaps the Chairman announces this has ended, have to generally done two years out of carried on active obligation or the complete several months (at the very least 90 days) in which these were called or purchased so you’re able to active obligation, and become released less than conditions apart from dishonorable. Exclusions are allowed in the event the veteran finished at least 90 days out-of energetic obligations but are released earlier than 2 years getting (1) adversity, (2) the convenience of the government, (3) reduction-in-force, (4) certain diseases, otherwise (5) service-linked impairment. Reservists and you can Federal Protect people meet the criteria when they had been activated once Aug. step one, 1990, supported at least ninety days, and gotten an enthusiastic honorable discharge.

Virtual assistant claims the mortgage, maybe not the condition of the property

Effective Duty Teams: Up until the Gulf Combat time is actually concluded for legal reasons otherwise presidential proclamation, individuals towards energetic obligations meet the requirements shortly after helping for the proceeded effective obligations for 90 days.

People in this new Selected Set-aside: North Carolina installment loans Everyone is qualified whether they have done at the very least six decades from the supplies or National Guard otherwise was basically discharged on account of a support-linked disability. This qualifications expires . Reservists that do perhaps not be eligible for Va property loan benefits will get qualify for loans to your beneficial conditions insured of the Government Property Administration (FHA) of Department from Casing and you may Urban Creativity (HUD).

Others: Most other eligible somebody are single partners off veterans or reservists exactly who died towards effective responsibility or down to services-connected grounds; spouses from active-duty service participants have been shed in action or a great prisoner-of-war for around 90 days; U.S.