General Advantages of choosing the fresh Virtual assistant Home loan

You should notice, you can reuse the latest Virtual assistant home loan

3. Previous Fund Energized To Entitlement – Your past funds and exactly how far entitlement you utilized is shown inside area. A huge amount of folks arrived at myself inquiring if they can recycle it and response is Sure, However,, there could be specific pastime revealed in this area who warrant a flavoring or prepared months one which just reuse your Va Financing.

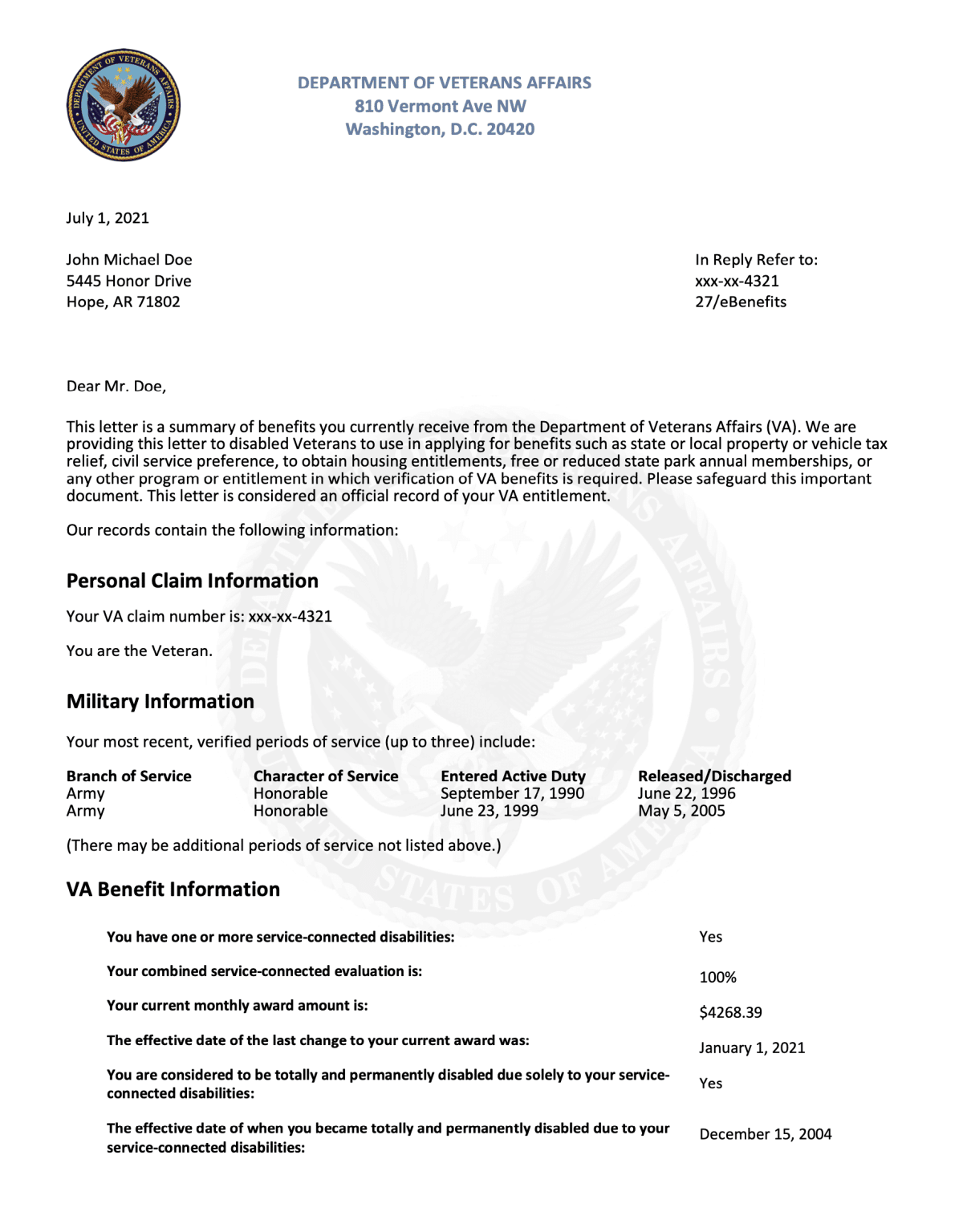

cuatro. Basic/Extra Entitlement – Entitlement ‘s the matter a veteran possess available for something called a guarantee with the that loan. We shall enter the term warranty within a second, however, first, it is essential to understand all the seasoned that is qualified to receive that it mortgage tool is discover doing $thirty-six,000 off very first entitlement. A loan provider will normally provide around fourfold that it matter. One entitlement may go down if you are using they, and will end up being restored through the years. You will see an asterisk (*) close to your own entitlement for example there was extra entitlement readily available to ensure that 4 times matter is not necessarily the limit loan your can have.

Warranty – That it term can be used to determine simply how much the Virtual assistant is responsible for to your lender, just who offers a good Virtual assistant financing. The Va does not topic currency, they just warranty loans. Find out how that actually works? A beneficial Virtual assistant acknowledged lender will provide you with currency without off commission conditions once the Va loans bring it guarantee in the event a seasoned domestic gets into foreclosure otherwise enjoys a short product sales, plus they are unable to pay off the financial institution the money it lent.