second Lien Enterprises Eye Piggybacks having Va, FHA Presumptions

PHILADELPHIA – For a change week’s MBA Annual Meeting, numerous 2nd mortgage players talked about increasing need for presumptions for the government first mortgages which need the homebuyer to take out a good junior lien.

Before going on the experience, Jerry Schiano, President out-of Spring season EQ, acquired a mobile call away from some one seeking input whenever you are eagerly seeking so you can navigate brand new unknown terrain out-of next mortgage investment for financing presumptions.

Mortgages secured by Agency out of Veteran Situations or covered of the the newest Federal Property Government will likely be believed of the property consumer, and the buyer commonly requires the next mortgage. It is a tempting option for homeowners during a difficult home industry – seizing a seller’s relatively cheaper financial – that is included with detail by detail structuring and needs appropriate for the much time-winded words. However, the newest bizarre product provides taken adequate focus – and you may intrigue – to emerge as the a development in second home loan credit and beyond.

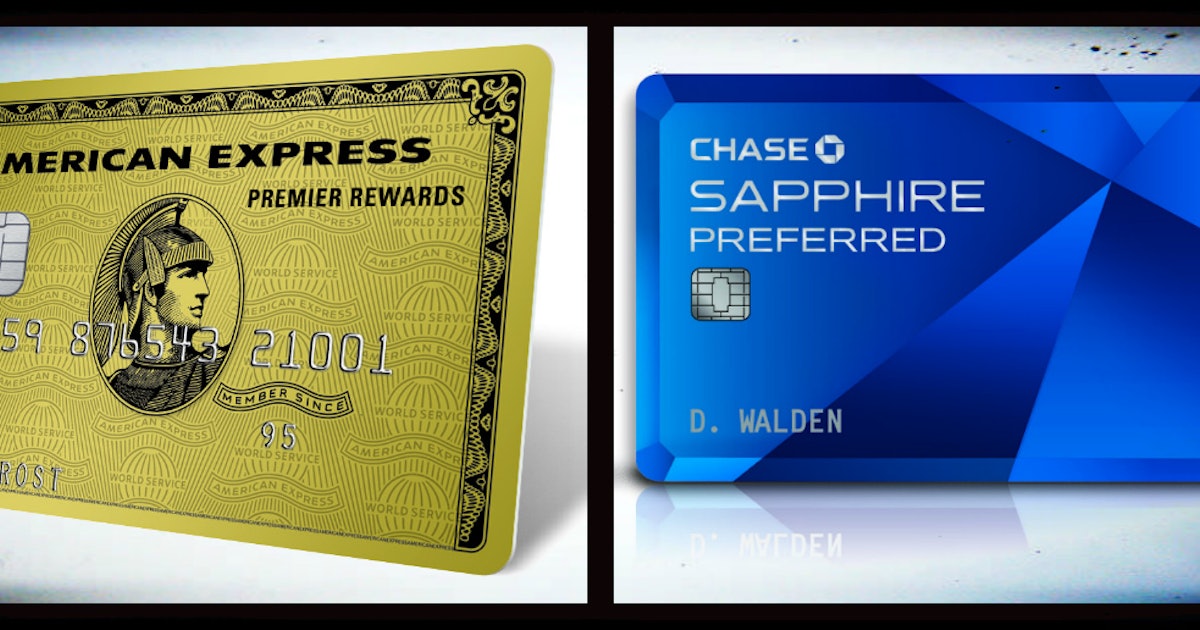

“There are creative people trying to profile you to away now,” said Schiano, who went to the 3-big date convention, and this ended Wednesday, in the hometown. “I simply got a visit out-of a guy who’s got basically seeking to get results thereon expectation, following offer a home collateral second to own differences ranging from in which you to definitely mortgage is actually plus the get. Truth be told there wasn’t a good amount of you to over yet. But needs, what is the old saying, ‘s the mommy regarding creativity. And in case good step three% very first feels as though gold dust when you have an enthusiastic 8% otherwise eight.5% sector.”

In the a great id restricted inventory, and in case an excellent Va or FHA financing proves powerful to help you the borrowers

Multiple loan providers seem to require into the on gold-dust, attempting to master the fresh new intricacies of the unconventional device when you’re partnering to the best folks: Brand new Va or FHA have to agree the consumer getting money because of a good persnickety software procedure that comes with a credit reputation.