General Advantages of choosing the fresh Virtual assistant Home loan

You should notice, you can reuse the latest Virtual assistant home loan

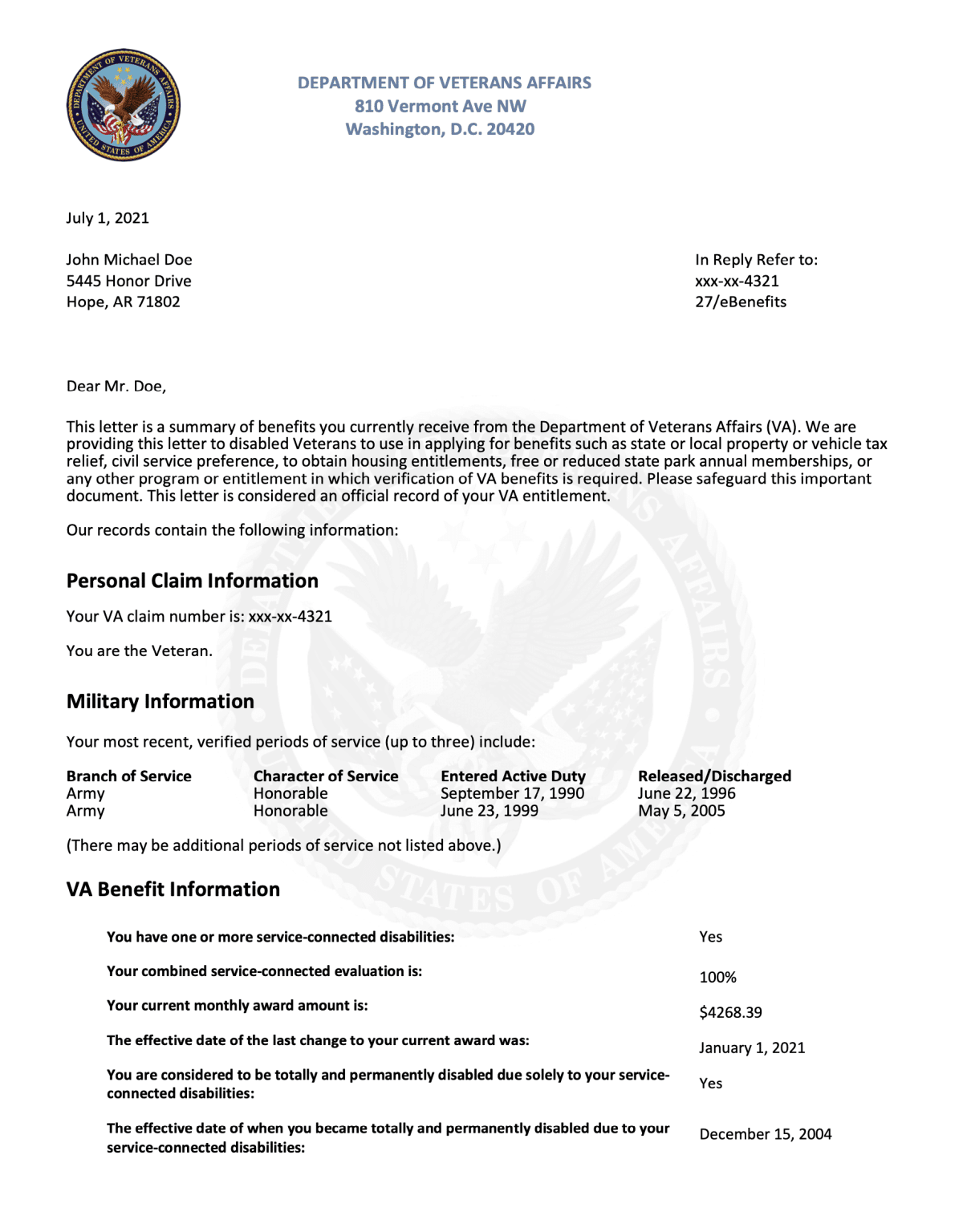

3. Previous Fund Energized To Entitlement – Your past funds and exactly how far entitlement you utilized is shown inside area. A huge amount of folks arrived at myself inquiring if they can recycle it and response is Sure, However,, there could be specific pastime revealed in this area who warrant a flavoring or prepared months one which just reuse your Va Financing.

cuatro. Basic/Extra Entitlement – Entitlement ‘s the matter a veteran possess available for something called a guarantee with the that loan. We shall enter the term warranty within a second, however, first, it is essential to understand all the seasoned that is qualified to receive that it mortgage tool is discover doing $thirty-six,000 off very first entitlement. A loan provider will normally provide around fourfold that it matter. One entitlement may go down if you are using they, and will end up being restored through the years. You will see an asterisk (*) close to your own entitlement for example there was extra entitlement readily available to ensure that 4 times matter is not necessarily the limit loan your can have.

Warranty – That it term can be used to determine simply how much the Virtual assistant is responsible for to your lender, just who offers a good Virtual assistant financing. The Va does not topic currency, they just warranty loans. Find out how that actually works? A beneficial Virtual assistant acknowledged lender will provide you with currency without off commission conditions once the Va loans bring it guarantee in the event a seasoned domestic gets into foreclosure otherwise enjoys a short product sales, plus they are unable to pay off the financial institution the money it lent. The financial institution gets a quantity throughout the Virtual assistant, secured. To pay for this chance, thanks to this the new Virtual assistant charges a financing commission up front having low handicapped experts with this particular mortgage equipment.

My team such as for example, we’ll give toward a beneficial Virtual assistant mortgage to $dos mil

Financing Restrictions – The latest Virtual assistant doesn’t set a limit exactly how far you is borrow to finance your home. Although not, you will find restrictions into the number of liability the brand new Va can also be suppose, which has an effect on how much cash a business have a tendency to lend your. The borrowed funds limitations are the number a qualified Veteran with complete entitlement could probably use in place of and also make a down-payment. Could you get a more costly home utilizing the Virtual assistant loan? Yes. Might you go over this new condition mortgage maximum with 100% money? Zero. Attempt to set-out some funds. Most of the financial would be different in terms of the level of chance they are able to just take and just how most of a percentage your own downpayment could be. If you’d like to see what your counties financing restriction is actually, test online payday loan California it follow this link.

Very chances are, you are probably moved regarding the making use of your Va Benefits, and i also will be moved as well! It is an amazing system you to definitely pros and you may energetic duty service participants that have ninety days under the buckle, can qualify for and start building a secured asset into the a house that one may label your own. Below are a few serious PRO’s concerning Va Home loan

- No Individual Mortgage Insurance policies (PMI)

- Not to getting mistaken for homeowners insurance, hence covers your residence off ruin, PMI covers lenders in the event that borrower doesn’t set 20% down using a normal financing, or if you have fun with FHA period. It handles the financial institution as you, an individual, are using PMI each month near the top of their principal interest, taxation and insurance policies. It’s one more monthly premium you are spending to the financial to protect them should you standard on your own financing. Quicker surface regarding the games, or otherwise not high enough borrowing to be eligible for a conventional financing, then you are investing PMI having fun with the individuals other dos financing products. Fortunately, Virtual assistant fund Lack PMI!