Most domestic people know that you will find three credit reporting agencies: Experian, Equifax, and you will Transunion

It is generally you can to utilize funds from a pension account for the deposit otherwise closing costs for your house get. The rules having making use of old-age profile differ, according to variety of membership(s) you have. I will number the typical legislation for every account variety of, in the.

Fico scores

This type of bureaus are repositories of information regarding all participating creditors. Ahead of credit scores stayed, credit agencies gathered and you can offered information regarding creditworthiness to lenders. The first credit score was developed into the 1989 by Fair Isaac.

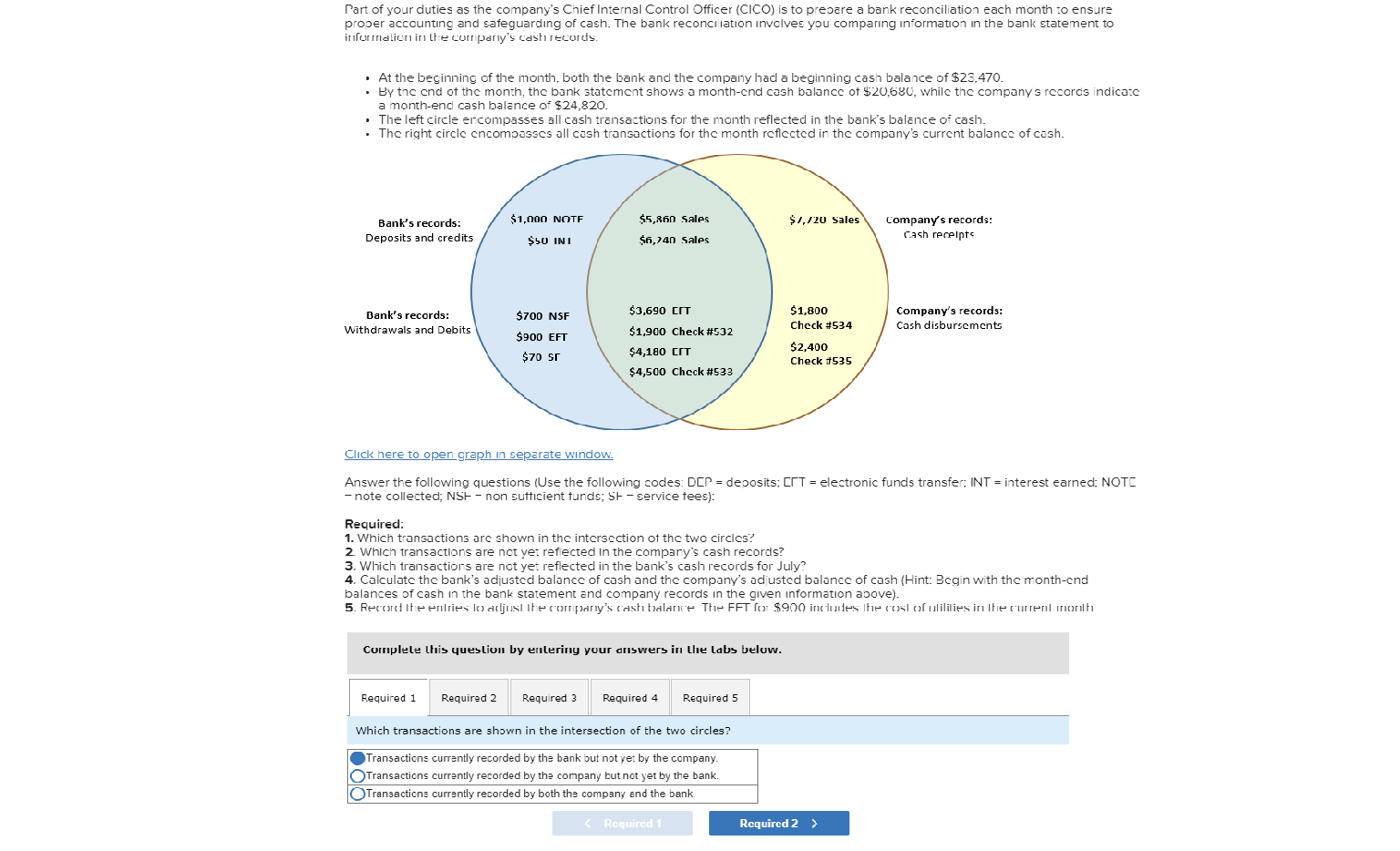

You can find down-payment recommendations and you may low down commission applications available one another across the nation and you can in your community. You will find composed underneath the definitions each and every program to assist when you look at the wisdom what is readily available. Using your initially talk, we will remark your debts observe what is the better fit for your.

Employment records

As soon as you submit an application for a loan, you will end up needed to bring a two season reputation of sometimes a career otherwise time in university. If your money is actually salaried, we’re going to determine and you can qualify your earnings centered on your own paycheck. In case your income are variable which is hourly, incentive, fee, or via information, we are going to.

Financing Limitations Upsurge in 2018

Beginning with closings when you look at the 2018, the fresh compliant loan restrict is $679,650. This’ll function as the restriction financing having a 5% off you to definitely-loan-circumstances, which can be a cost regarding $715,421. Yet not, 5% off is offered around pick prices from $978,578 that have funding which have a couple of fund. 3% next page down usually.

Recast

An effective recast differs from a great refinance. The objective of a great recast should be to lower your payment per month without having to sign up for a new loan. Which have a good recast, you will lower the principal equilibrium and request the lending company recalculate the lower mortgage repayment in line with the down harmony. Within the.

Refinance

It certainly is a delight to help you understand the benefit, costs, and you may procedure for refinancing. This is the secret information that’ll help me provide information so you can your, and email me these records Elizabeth-send me personally. If you don’t have the ways to this new below, which is Ok!: Your home.

My part since your financing administrator would be to help guide you during the choosing just how to better finance your property pick. You will find some mortgage applications available, as well as the best bet to you will be based upon investigation from your income, bills, property, borrowing from the bank, and your desires and you may long lasting plans.

Financing

Antique Fund – Most useful combined with large borrowing from the bank and/or maybe more downpayment. providing the most useful words for the majority of people FHA Money – Best paired with all the way down borrowing from the bank and you can/or lower down payments. delivering advanced loan terminology in the a lot more than days Jumbo Fund – Having mortgage number more than $636,150, jumbo money require slightly higher down money.

You will find down-payment direction and you will low-down fee software available both across the country and you may locally. I’ve written underneath the definitions of each and every system to aid in the skills what’s available. During your first dialogue, we are going to remark your debts to see what is the ideal fit for your.

Transfer Taxation

First-time visitors potential taxation coupons towards the settlement costs: DC: .375% to .725 of purchase price MD: .25% from purchase price. In Maryland, home buyers with never possessed home on state and are to get a first quarters are exempt regarding state import tax, and therefore saves .25%.

Occupancy

You can find around three variety of methods need a home you are resource. They are a first household, 2nd family, otherwise investment property. A first house is a property the place you live in as your prominent house, and you will generally speaking undertake at the least a lot of the year. Within the.