Most profitable forex trading strategies 2023

Content

They need to consider the risks in increasing their position size and avoid taking impulsive trades. In this case, wait for a bullish candle to close, then enter a buy trade. The accompanying illustration depicts the Bollinger Bounce strategy in action using a real-time gold quote on Mitrade. The pinbar strategy is a technique that uses one element of Japanese Candlesticks to predict future price movement.

The most lucrative performance is observed in long-term scenarios, so focus on these. On the whole, shrewd players do better than traders of benchmark stocks. The randomness principle does not hold true because trading involves fees and other charges. If Forex zero-sum game really existed, even distribution could be expected. However, retail trader needs to pay for their access to the market. This includes spreads or commissions (depending on the broker) to open and close a position.

How profitable a currency pair depend on traders’ individual risk management and strategy. Market analysis plays a crucial role in profitable forex trading. Analyzing the market enables forex traders to spot trends and market movements before they happen.

Its registered office is Hinds Building, Kingstown, Saint Vincent and the Grenadines. He worked in several other firms before establishing his company in 1970. His rise to international fame began in 1992 when his trade shattered the Bank of England and gave him a $1 billion profit. A counterparty risk is a probability that the other party in a trade transaction may default on their contractual obligations and not fulfill their part of the deal.

Breakout Trading Strategy

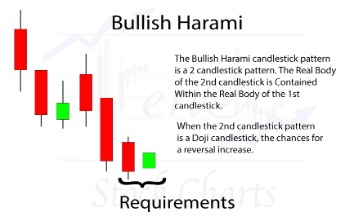

The first is technical analysis, which focuses on exchange rates and other market observables and their levels and fluctuations. This strategy appears to be particularly useful for forecasting short-term market conditions. While Forex trading may be exhilarating, it is not for everyone. https://g-markets.net/helpful-articles/46-psychological-marketing-examples-for-smarter/ There is no single formula for successful trading in the financial markets. The global Forex market is attractive to many traders due to its low-cost account, day and night trading. Red arrows point to the candlesticks that had large bodies relative to the previous bullish candlesticks.

- Another reason for losing money in forex is your choice of a trading platform.

- There have been occasional cases of fraud in the forex market, such as that of Secure Investment, which disappeared with more than $1 billion of investor funds in 2014.

- You have to have the discipline at this time to believe in your method and not to second-guess it.

- The monthly candlestick chart below for EUR/USD shows an upward trend in progress after a significant decline.

- You are strongly advised to obtain independent financial, legal and tax advice before proceeding with any currency or spot metals trade.

For instance, one analyst may distribute up to five signals daily to premium members. These signals may contain the forex pair to trade, entry price, take-profit orders, and stop-loss orders to place. Staying updated with the latest news releases is one way to help you improve your forex trading profitability. Many market moves happen because of significant events like news and announcements or the expectations of such releases. This trading parameter enables you to specify your trade’s closing price. Stop-loss closes the position automatically at that amount when the actual price hits this level.

Example of Unprofitable Leveraged Forex Trade

But this strategy considers only the MA position relative to the price movements. Some brokers advertise trading without deposit, but the amounts are relatively modest. Such welcome offers may only be used for your first steps in the live market — ideally, after several months of demo trading. According to the percentages cited by critics, only 10-15% of all Forex/CFD clients make a profit.

The low end of the range is $54,000, while the high end is $179,000. Vanguard is one of the biggest investment companies in the world, with over $4 trillion in assets under management. For low commission fees, Vanguard offers a wide range of investment products, including stocks, ETFs, mutual funds, IRAs, and 401(k) plans. Since its launch in 2007, eToro has acquired over 25 million users globally and established trading in crypto, stocks, and ETFs. With its zero-commission fees, extensive educational resources, and a CopyTrader feature, eToro is a great option for beginners who want to dip their toes into the world of online trading. How much you can make with $1,000 will depend on how successful you are in predicting the market, whether or not you use leverage, and the number of pips generated over a specific period.

Even if you’re not an accountant or maths expert, your trading broker should have the tools to help you with those calculations. Slippage can result in more significant losses than expected, even when you use a stop-loss order. When you calculate your profit, consider including slippage in your computation. Finding several good trades every day is challenging, if not impossible. While this is a fantastic ROI, since the capital is so small, it’s not a feasible return for someone who wants to take this up as a profession. The amount of capital you have to invest will play a significant role in how long it takes to be successful to the extent that you can make this your full-time income.

Scalping can be a highly effective way to make quick profits, but it also requires fast thinking and quick reflexes. Risk/reward is a term that refers to the amount of capital that is risked in order to get a specific profit. If a trader loses 10 pips on a failed purchase but gains 15 on winning deals, they make a profit by winning the trade.

How Does Leverage Impact Profits in Forex Trading?

As long as they are not excessive, failed trades should not be construed as disastrous. Traders use fundamental and technical analysis to make informed decisions. Long or short positions should be chosen based on the predicted direction of the price. For instance, if you intend to earn a million, but have only $10,000 in your account, do not expect quick results.

Once an investor has chosen a currency pair, they speculate on how much of one currency they can purchase using the other currency in the pair. Investors are not limited to trading in their own country’s currency, which provides plentiful options for trades. Second, enthusiastic news and statistics will build trading strategies around news releases, elections, and other current events. Currency options offer you the right at a given date and time to buy or sell currency at a fixed price. You can exercise the option for a benefit if the details work out in your favor. No matter their background and expertise, Forex is accessible to everyone.

How to Make Money With Forex?

Daily correspondence with banking experts gave me insight into the systems and policies that power the economy. When I got the chance to translate my experience into words, I gladly joined the smart, enthusiastic Fortunly team. Some people prefer the stability of stocks, while others like the quick profits of forex. Ultimately, it’s up to you to decide which market you’re more comfortable with. According to data collected by Indeed, the average annual salary for a forex trader in the US is $98,107.

- It’s one of the most popular forms of trading and can be extremely lucrative if done correctly.

- You can exercise the option for a benefit if the details work out in your favor.

- Finally, the size and structure of the firm also play a role in determining compensation.

This is based on the premise that markets rise and fall all the time. Pullback involves jumping in once the market goes against the trend — for instance, a dip has followed an upward movement. This means if they rise today, tomorrow is likely to bring a fall.

Best Way to Trade Forex Profitably: Deposit Tips

For example, independent traders typically earn less than those who work for major banks or hedge funds. In general, though, professional forex traders typically have the potential to earn substantial incomes. They also have a solid risk management strategy in place to minimize their losses.

A stop loss is set close to the local low, take profit is points. But if you manage trades manually, you can make a bigger profit. Occasionally, the LWMA may send an early signal in the long run.

Overnight trades that remain open after 5 pm EST also require a fee. The current estimate of George Soros’ net worth is $8 billion or more. The danger that forex traders face is not limited to unforeseen one-time occurrences. Although large entities complete most forex trading, starting as an individual investor is fairly straightforward. Many broker sites allow investors to create a profile and fund an account, just like they would for fund or stock trading.

For long-term operations, a professional trader with a starting capital of around £1,700 ($2,113) may obtain monthly performances of 5% to 7% on average, excluding drawdown periods and taxes. The risk-reward ratio is how much capital you risk to attain a particular profit. If you lose 10 pips on losing trades but earn 15 on winning ones, you are profiting more from the winners than you are losing. If you’re a beginner, swing trading may be one of the best strategies for forex trading. Unlike scalping or day trading, swing trading provides more flexibility because you can keep a forex position from a few days to several weeks.

To ensure that one remains profitable in trading the forex market today, we have highlighted some essential factors necessary to maximize profits. A well planned strategy will always help you avoid emotional trading and behavioral biases, and enable you to stay focused. ’, this is the question that every trader asks himself while entering the world of Forex trading for the first time in 2022. However, there is no final answer, but there are some factors to consider. However, we may consider in percentage terms by examining the Forex market’s trading tactics. To begin, news spreads quickly among Forex traders, who face considerable volatility, and these markets are notorious for their rapid movement.