Simple tips to Pertain Which have a premier Mortgage lender

Particular lenders operate better for sure individuals otherwise activities than just anybody else. Eg, we feel Skyrocket Mortgage is an excellent bank to own refinancing since the it’s the ability to personalize their identity length, that allows one prevent resetting your loan identity.

Good for First-Go out Customers

Within our help guide to the best mortgage brokers having first-date homebuyers, Financial off The usa are our very own ideal get a hold of. A beneficial lender to own basic-big date buyers would be to promote funds featuring especially geared toward such consumers. Discover loan providers with lowest-down-commission mortgage loans and gives a lot more let such as for example deposit gives.

Perfect for Regulators-Supported Mortgages

- Within our guide to an informed lenders for FHA financing, The new Western Money try our top pick

- Experts Joined is the “best overall” get a hold of in our ideal Virtual assistant loan providers guide

- Fairway Independent try the top pick to own USDA loan lenders

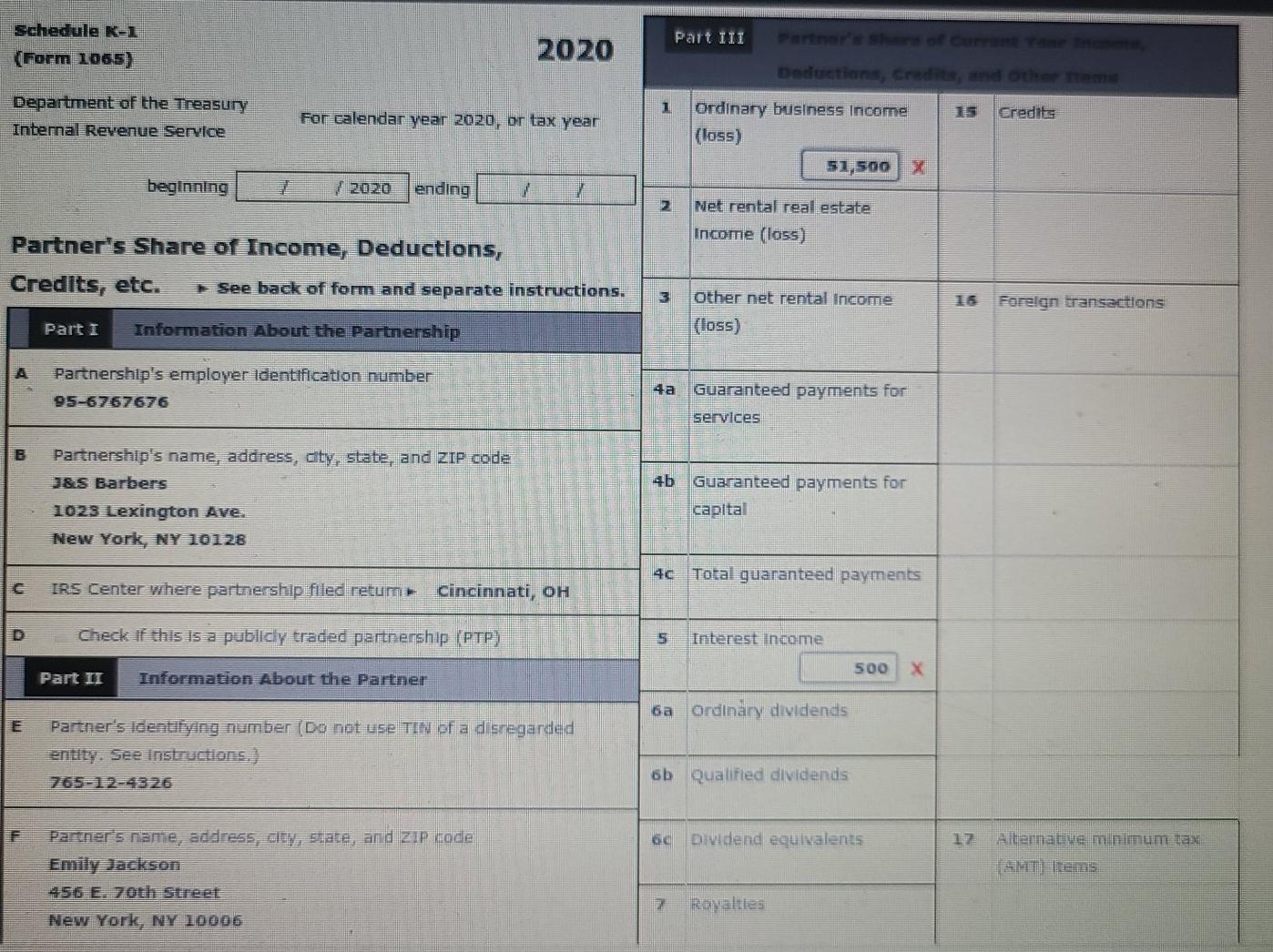

Planning The Records

Lenders have a tendency to ask for a variety of data once you sign up for a home loan, so it is best if you have them working ahead of time. This will likely include paystubs, W-2s otherwise 1099s, tax returns, financial comments or other house membership statements, and any other papers demonstrating your revenue and you will offers.

Understanding the Mortgage Application Process

Generally, the loan app techniques begins with a great preapproval. With this specific style of acceptance, the lender takes a glance at your own borrowing from the bank and you can profit and let you know simply how much it is ready to give you based on the recommendations it looked at. You plan to use your preapproval buying belongings and then make also offers.

After you’ve a deal acknowledged, you can easily apply for approval. The financial institution can get require alot more paperwork at this stage, also a copy of your own finalized get price. Once you will be acknowledged, you get financing guess with the specifics of the recommended financial, along with projected settlement costs.

If you move ahead, the lending company will start running and underwriting the loan. It can buy an appraisal to make certain our home was worth just what you accessible to pay for it, and you may underwriters are working to verify you meet up with the lender’s criteria and certainly will spend the money for financing. When the all goes well, you’ll receive latest approval and become eliminated to close.

Finest Home loan Financial Faqs

What’s the better lender to track down home financing? Chevron icon It indicates an expandable point or diet plan, otherwise often previous / second navigation choices.

The finest discover lending company is actually Bank from The usa, however, that doesn’t mean this is the greatest financial on exactly how to get home financing away from. A knowledgeable home loan company for your requirements is but one that you meet the requirements with this offers the particular financial you are interested in and certainly will offer the best deal in terms installment loans in South Dakota of its rates and you can fees.

Exactly what financial gets the reasonable mortgage rates? Chevron symbol It means a keen expandable part or selection, otherwise either prior / 2nd routing alternatives.

Towards the bank to the lower financial rates, we advice Finest Home loan based on its average prices when you look at the 2023, however you will discover down rates in other places according to your own personal finances. Have a look at Organization Insider’s every single day financial rates updates so you’re able to comprehend the mediocre home loan costs a variety of title lengths.

If you get preapproved by the multiple loan providers? Chevron symbol This means an expandable area otherwise selection, or both previous / 2nd navigation selection.

Sure. You need to apply for preapproval with well over one to home loan company examine this new pricing and features you might be to be had while making sure you get an educated bargain.

How much is actually a home loan software payment? Chevron icon It means an expandable section otherwise diet plan, or possibly earlier / second routing choice.