Va LoansVA fund is designed particularly for experts, active-responsibility armed forces group, and you can eligible thriving spouses

Into the Tulsa, many home loan applications are around for address more economic requires and homebuyer issues. The following is a closer look at a number of the well-known selection:

These types of finance offer favorable conditions and lower down money, causing them to good selection for people that be considered

These loans promote several advantages, including beneficial terminology, zero need for a deposit, and no dependence on individual home loan insurance rates (PMI). This will make all of them an excellent option for people who qualify, getting tall cost savings and you may obtainable a mortgage.

Conventional LoansConventional finance are not backed by any authorities service, instead of Va or FHA money. They often incorporate repaired rates and flexible conditions, in fact it is tailored to complement some financial products. But not, sometimes they require large fico scores and you will huge off money opposed to help you Va money. Traditional funds are a famous option for people who meet with the borrowing from the bank and you may down-payment criteria.

FHA LoansFHA finance is actually insured by the Government Property Management and you can are designed to assist individuals which have all the way down credit ratings and you may less down costs. Such fund are ideal for very first-date homebuyers otherwise people who have smaller-than-primary borrowing from tribal loans no teletrack online direct lender the bank, and make homeownership significantly more doable. The insurance provided with this new FHA facilitate mitigate lender exposure, making it possible for alot more available financing terms.

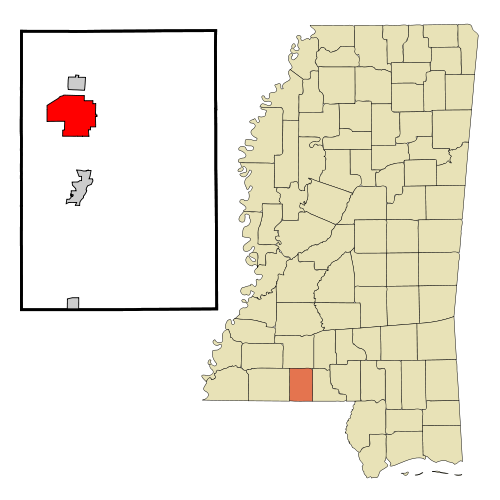

USDA LoansUSDA funds are created having homeowners in rural parts and supply the advantageous asset of zero downpayment. Backed by the usa Service regarding Farming, such fund are a great choice for those looking to buy a house into the eligible outlying and you will suburban portion. The possible lack of a down payment demands is also notably slow down the upfront costs of getting property.

Section 184 LoansSection 184 finance are designed specifically for Native American homebuyers. The application form aims to give homeownership contained in this Local Western groups by providing obtainable and you will affordable capital alternatives.

Re-finance LoansRefinance funds make it home owners to change its existing mortgage terms otherwise interest rate. This can be ways to reduce monthly obligations otherwise reduce the borrowed funds title, probably saving money over the years. Refinancing will be a strategic monetary flow in the event the rates of interest has dropped or you must change your loan’s construction.

Money spent LoansInvestment assets fund is directed at to invest in functions to possess rental otherwise money intentions. This type of financing are made to assistance home investors trying acquire leasing home and other resource services.

2nd Domestic LoansSecond home loans are used to buy trips house or more houses. Such funds may have more criteria compared to the money for primary residences, showing the unique need and you can economic users regarding next-home buyers. They give you an opportunity for visitors to own several qualities.

Jumbo LoansJumbo loans is actually intended for highest-pricing features that go beyond the brand new conforming financing limits lay of the government providers. These fund generally speaking feature more strict conditions but provide aggressive pricing having big loan number. He or she is perfect for consumers looking to fund more expensive functions.

They often feature different conditions and terms compared to important mortgage brokers, showing this new capital characteristics of the property

Down payment Recommendations ProgramsDown commission advice software are made to let first-time homeowners that have grants or reduced-appeal loans to afford advance payment. These types of apps make an effort to make homeownership way more accessible by reducing the brand new monetary hindrance of your advance payment, helping more individuals to find the very first household.

First-Go out Home Buyer ProgramsFirst-date homebuyer software render unique advantages such straight down rates of interest or downpayment recommendations. Such apps was designed to assist the fresh new customers go into the houses market with more good resource words, putting some process of to order an initial family smoother and a lot more sensible.