Why must You prefer a money-Out Re-finance Bank?

- Punctual resource: Funds close in typically 21 weeks

- Flexible loan numbers: Acquire out-of $25,000 around $five-hundred,000

- Highest mortgage-to-value: Well-certified individuals can be acquire around 95% of the residence’s worthy of

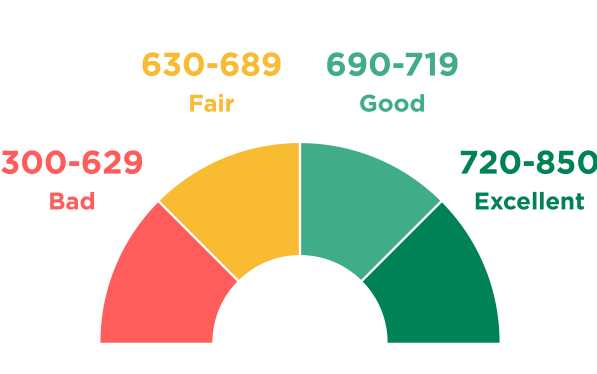

- High credit score expected: Need a credit rating with a minimum of 640

- 40 says: Simply serves on the forty claims and you may Washington, D.C.

- No online rates prices: Cannot discover speed quotes on the web

What is actually a cash-Out Refinance Bank?

A cash-out re-finance financial is a lending company that assists residents replace their primary mortgage loans with new, huge funds and money from variation. Such as for example, when your house is worthy of $450,000 and you can a lender possess a keen 85% loan-to-well worth maximum, you could acquire as much as $382,five-hundred. If you nonetheless owed $two hundred,000 on the domestic, you will be in a position to cash out up to $182,five-hundred.

How can Cash-Out Refinance Loan providers Performs?

Many dollars-away refinance loan providers provide on the internet prequalification and you may application systems. To find out if your prequalify, you’ll want to visit a good lender’s web site and gives information regarding your home, earnings, credit and more. The financial institution will then opinion your application and give you a quote of your own different bucks-aside refinance fund you can buy.

Terms can vary extensively into bucks-out re-finance financing of less than 10 years as much as 31. Further, loan providers tend to promote both repaired and you can adjustable interest selection. They also usually fees closing costs ranging from 2% and you can six% of your own amount borrowed and may charge things.

If you find that loan that looks such as for example a great fit, the next phase is to go through with the complete software. In that procedure, loan providers normally request documents to confirm all the information you’ve provided, schedule a property appraisal and you can do a challenging credit score assessment. Abreast of approval and enjoy of financing, their early in the day mortgage might be repaid, plus the left matter might be wired to the bank account.

When you discover a cash-aside home mortgage refinance loan, brand new installment several months initiate. You will end up needed to build monthly premiums that come with prominent and you can interest till the loan is paid off entirely.

A money-aside mortgage refinance loan makes you would a couple of things: Refinance your mortgage and you will utilize your house equity in place of attempting to sell your property.

Refinancing mortgage tends to make feel whether it can help you in some method, particularly cutting your payment count otherwise total cost. You to or both of these are usually possible in the event the pricing enjoys dropped as you got the financial or you qualify for top cost because of enhancing your borrowing. Most other possible experts become switching to a loan provider with best customers services, shortening your own cost identity otherwise altering your loan sort of.

As for tapping into your residence equity, this offers a lump sum of money you to definitely you can utilize to attain different requirements. Such as for example, you may:

Funds home reily space, upgrade your cooking area otherwise build a different sort of do-it-yourself? An earnings-out refinance can help you fund it. A selling point of purchasing the amount of money that way would be the fact desire towards fund regularly pick, make otherwise repair a house might be income tax-deductible.

Consolidate highest-focus debt. Cash-away refinance funds commonly come with relatively low interest because the installment loans online Utah they’ve been safeguarded by your home. Thus, capable promote an installment-effective way so you can refinance high-desire obligations of unsecured products like playing cards, unsecured loans and you can figuratively speaking.

Begin a corporate. Have a great organization idea? When you are undertaking a business can be an expensive endeavor, a profit-out refinance loan can help you money it and also have the fresh golf ball going. Yet not, you can even imagine loans that aren’t truly guaranteed otherwise safeguarded from the individual property very first.