Exactly what do You ought to Be considered so you’re able to Refinance a beneficial HELOC otherwise Household Collateral Loan?

Once you refinance you only pay off of the financial and replace it with a brand new mortgage. Once you re-finance a house guarantee mortgage, you are settling the initial home loan harmony or household security line and substitution it with a new 2nd home loan or HELOC. When you’re refinancing an effective HELOC, you’re removing the newest variable focus merely costs and you can converting it towards the a fixed interest rate financing that have a predetermined monthly payment.

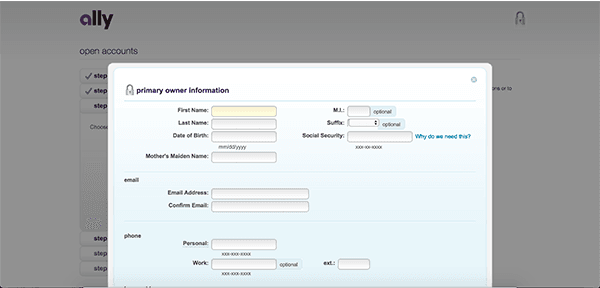

One which just strive for a separate house collateral mortgage having a lower payday loans Grimes life expectancy rates, you should know exactly what the prospective requirements is actually.

Here is the back-stop proportion, that’s a measure of all your monthly financial obligation money than the the terrible month-to-month earnings.

If you would like refinance for taking advantageous asset of straight down cost, it will help to increase your credit score doing you’ll.

When your credit rating was under 700, you will get difficulties qualifying for the best prices. A bit the financing rating conditions to have HELOCs differ than simply fixed price guarantee fund, so make sure with the bank while shopping second financial solutions.

How to Lower the Financial Speed to my House Equity Mortgage?

Refinancing a home collateral mortgage entails replacing your current mortgage with a special one, maybe locate a diminished interest, customize the installment identity, otherwise accessibility a lot more equity resulting from their house’s appreciated really worth.

- Contrast the current rates towards the current family collateral mortgage rates.

- Cause for settlement costs since if your roll all of them the loan number increase.

- Compare your existing monthly payments towards the advised the fresh new loan.

- Believe refinance home guarantee mortgage costs which have repaired rate words.

In the course of time, no person can correctly assume whenever financial costs will start to miss. In the event your pricing cited by the house equity loan lenders is actually unsustainable to you, it’s wise never to proceed with the expectation you could re-finance later on. The new time are undecided, plus this new meantime, your risk dropping your home if you fail to match the fresh monthly obligations. It is therefore wise to re-finance your home security loan in the event that you’ve got the capacity to save money that have straight down monthly premiums as well as change your terminology. Choose the best house collateral mortgage rates on line.

Ought i Refinance a home Collateral Loan getting a better Words?

An alternative choice is to re-finance to a house security financing having yet another title length, often expanded otherwise shorter, based in the event your point is always to reduce your monthly obligations otherwise expedite mortgage fees. While doing so, for those who has actually extra collateral of your property, you’ve got the opportunity to re-finance into the a more impressive household collateral amount borrowed, permitting access to a lot more cash.

For example, when you’re refinancing an effective HELOC or security loan which have a balance regarding $50,000, expect to pay ranging from $750 and you can $2,five hundred.

Therefore if brand new costs was in fact $750, you would need to obtain at least $fifty,750 when you need to move the house guarantee financing closure can cost you for the this new financing.

Benefits and drawbacks out of Refinancing a home Equity Financing

Like most monetary choice, choosing to re-finance a home equity financing should be considered cautiously before generally making the final telephone call. Here you will find the positives and negatives regarding refinancing your residence collateral loan:

Masters Basic, you could potentially potentially decrease your payment, and when you qualify for a lesser interest. That have a lower life expectancy rate could allows you to save yourself considerably into desire over the years.

Second, you might refinance the loan towards the a lengthier otherwise quicker cost term. Switching to a lengthier title will reduce brand new fee however, often increase desire repayments. you you can expect to get a hold of a shorter identity, and therefore increases monthly installments however, decreases interest.