Autos Be more Reasonable Today. That isn’t Entirely a good thing

What are you doing in the car sector just like the interest rates slip? New investigation suggests that transformation was picking right on up, if you are discounts and marketing financial support sales has actually increased. Yet , best business towards this new automobiles are helping depress selling philosophy getting put automobiles, therefore the number of early in the day people who are obligated to pay much more about their fund than just its autos can be worth is also up sharply.

The brand new autos are providing from the look at this web site a video that is in the six% greater than last year. That is an indicator your field has become even more visitors friendly, considering a special statement off J.D. Fuel.

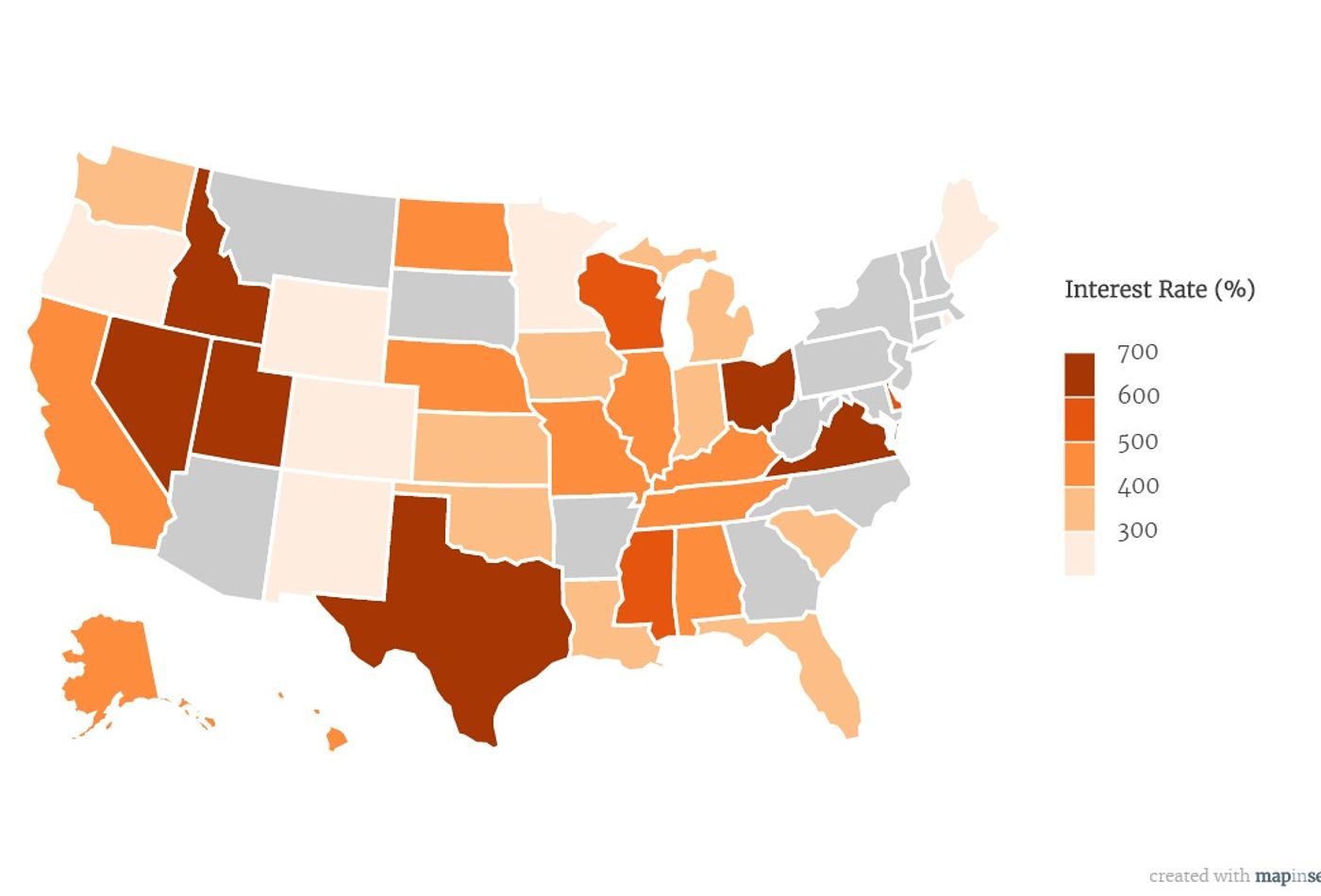

The fresh Federal Reserve’s September interest clipped provides encouraged developments inside the car loan resource. The typical interest for a special vehicle buy is expected to get up to six.7% within the October. That could be a decrease of around one or two-thirds off a share point weighed against just last year, the latest report told you. All those trucks also qualify for much-skipped 0% Annual percentage rate investment, considering the newest customer’s credit is up to par.

Cars Be a little more Reasonable Now. That isn’t Completely the best thing

The brand new Fed’s move isn’t every that is sending car investment pricing all the way down today. Additionally there is the result off just what auto world calls “extreme index,” like in a glut of the latest automobiles into the dealers’ lots. Just after age where interest in autos surpassed the production, a very typical equilibrium has returned, which have the new auto catalog right up by the 25% 12 months-over-season. And dealer tons may get far more congested, given that car of the design year 2025 are starting to help you started to dealerships nevertheless stuck which includes 2024 habits, based on Cox Automobile.

All of which is actually helping drive ideal deals for consumers. Instance, new car incentives is averaging about $step three,500 or around seven.3% of your automobile rates, right up of just under 5% this past year. Towards the throughout the 20 different models, those individuals rebates is located at least $5,000 approximately, with respect to the tracking web site RealCarTips.

The difficulties out of down automobile cost

Automobile costs are edging down; an average the new automobile today sells for $49,904, and therefore signifies a $7. However, such an average remains beyond the arrive at many users, who you are going to shortly after have bought minimal, reduced vehicle, hence less makers make a top priority nowadays.

Nissan is one of the conditions to this pricier trend. The business also provides about three 2025 activities that have sticker prices lower than $22,000, for instance the Versa, a concise sedan you to definitely initiate during the $17,190 on the guide adaptation.

The latest legacy off pricing that were even higher than just now try section of what exactly is trailing an upswing for the individuals with more mature trucks who’re “underwater” on the fund – which is, owing regarding the borrowed funds versus automobile is currently worth. Based on a recently available statement out of Edmunds, the newest ratio away from used autos having “bad equity” provides increased to help you regarding the one out of four agent exchange-inches, that is a 3rd greater than the pace just last year.

Nevertheless the question is not just how many for example consumers, Edmunds says, but how far they are obligated to pay. The business says the fresh new ratio out-of residents who are underwater in order to the new song of 5 data was “little lacking stunning.” More one in 5 customers that have negative security are obligated to pay far more than $10,000 on the car finance, and you may on the a 3rd of those individuals (seven.5%) are obligated to pay about $15,000.

Those individuals people experienced a two fold speed whammy. Many paid back across the checklist rates inside pandemic, whenever cost soared, and tend to be today experiencing a fall throughout the opinions getting put automobiles. The typical car price is on the $28,800, a good 4.8% drop away from a year ago, centered on Vehicles Commerce.

Not that utilized autos try necessarily significantly more sensible than simply the newest activities, because the price of funding is recognized as. Financing costs having used car are nevertheless averaging in the eleven%, and that the apart from the average costs for brand new autos, so there is a lot fewer incentives than simply when individuals purchase a new auto.