Understand the CFO role: Key responsibilities and essential skills Sage Advice US

This is not to say CFOs have relinquished their responsibility for cash-flow management, regulatory compliance, or financial reporting. The CFO is still ultimately held accountable for the financial health of the business—first and foremost. The duties chief financial officers perform can include overseeing investment portfolios, crafting financial reports, developing financial forecasts and tracking expenses. John Pokorney is the CFO of LeTip International, Inc., the world’s largest privately owned professional business networking organization. He started his career in financial management at Intel after receiving his MBA.

Chief Financial Officer (CFO)

Having a CFO signifies more than financial management—they’re a key driving force in guiding your company towards sustainable expansion and success. Increased accountability is another challenge a CFO may encounter during their career. If anything goes cfo title meaning wrong financially or funds are mismanaged, the CFO must address these issues with the company’s internal stakeholders. The CFO may also serve as an organization’s public face and can be tasked with providing statements or giving speeches to the media.

Chief Diversity Officer

- Communicating in a way that everyone can understand means avoiding financial jargon.

- With their profile now higher in the organization, there will certainly be even more pressure on CFOs to lead their organizations to sustainable, profitable growth.

- The position of CFO shouldn’t be confused with that of financial controller, with the latter being focused less on financial strategy, and more on the organization’s day-to-day financial operations.

- A key aspect of your CFO’s role in business growth is integrating financial expertise with overall business strategy.

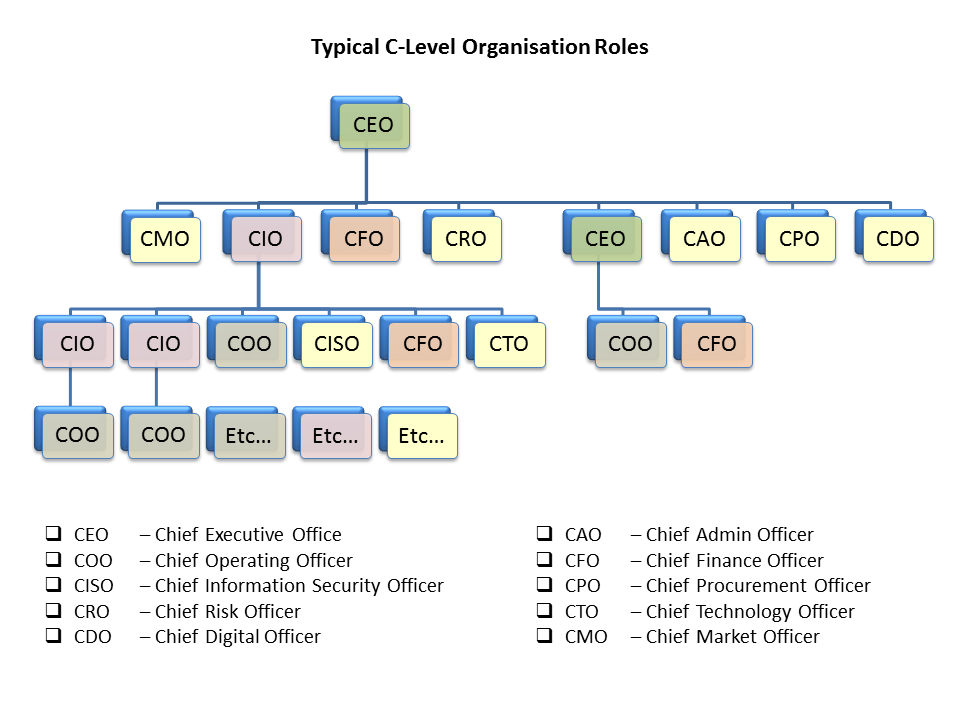

And the Chief Technology Officer might report the Chief Information Officer. Much of the role is now about collaborating with teams across the organization to execute the CEO’s vision. So, CFOs also need good soft skills in presentation, communication, leadership, and negotiation. Increasingly, CFOs need to know more about technology, risk management, supply chains, and environmental, social and governance (ESG) measures. Data analytics and data quality have become two of the biggest issues requiring CFOs’ attention, so data and analytical skills are also essential.

What education did you need to pursue this career? How did it prepare you for your current role?

I would sit on staff meetings with the operations managers, engineers, and the marketing team. This taught me the value of being part of a team and why it’s important everyone holistically understands a business’s operations. When I went to try to interview with Coca-Cola for a financial analyst position, I couldn’t get in the door because I didn’t have an MBA. To get job interviews with the types of companies I thought would give me exposure to the types of analysis I found interested, I decided to get my MBA. Once I got into thinking about my career, I had a role model in both my father, who was a VP of accounting at a stainless-steel company, as well as my cousin, who was a financial analyst at Coca-Cola. Both operational and strategic CFOs understand financial functions within a company.

What is a chief financial officer (CFO)?

According to Salary.com, the average CFO salary in the U.S. is $441,037, with the range typically falling between $334,103 and $565,829. The job of chief financial officer requires far more than just a good head for figures. Soft skills that are vital to the job include the ability to lead a team, liaise with other stakeholders and negotiate effectively, along with problem-solving and attention to detail.

What Skills Are Needed to Be a Chief Financial Officer?

I compiled a list of C Level titles to help you think about the executive org chart. The CFO role has changed dramatically over the last few decades, and their skills need to be much broader and deeper. Amy Spurling, CEO of Compt and a former CFO, says CFOs should build strong relationships with HR, as it holds valuable insights into people productivity and retention.

CEOs can come from any career background provided that they’ve cultivated substantial leadership and decision-making skills along their career paths. A chief marketing officer, also known as a CMO, is responsible for setting marketing goals and objectives for an organization. The primary role of a chief marketing officer is to manage branding, advertising and public relations. A chief diversity officer, or CDO, is a leader in an organization who develops, manages, and supports diversity and inclusion strategies. A chief diversity officer typically leads any diversity and inclusion initiatives. They may also be responsible for overseeing employees complaints about harassment or discrimination and developing culture change.

Typically, the CFO is the liaison between local residents and elected officials on accounting and other spending matters. The CFO sets financial policy and is responsible for managing government funds. Being proactive and thoughtful about formulating your career path will be essential for some. Others might get by with simply being aggressive and rubbing elbows with the right people. These execs are skilled at managing social innovation and product development initiatives across both brick-and-mortar establishments and electronic platforms as well which have become highly essential in the digital era.